Crude Oil prices declined 1.52% against the USD for the 24 hour period ending 23:00GMT, closing at 101.90, after increased supplies from Libya and as supply concerns receded after a leading broker indicated that the current crude stockpiles should be sufficient to offset the expected rise in demand for oil from the Organization of the Petroleum Exporting Countries (OPEC) in the second half of 2014. The crude oil prices continue to remain under pressure after reports revealed that crude production in the US rose to its highest level since October 1986.

Yesterday, the EIA reported that the crude stockpiles fell by 2.37 million barrels in the week ended July 4, compared to market estimates of a 2.75-million-barrel fall.

In the Asian session, at GMT0300, Crude Oil is trading at 101.8, 0.10% lower from yesterday’s close.

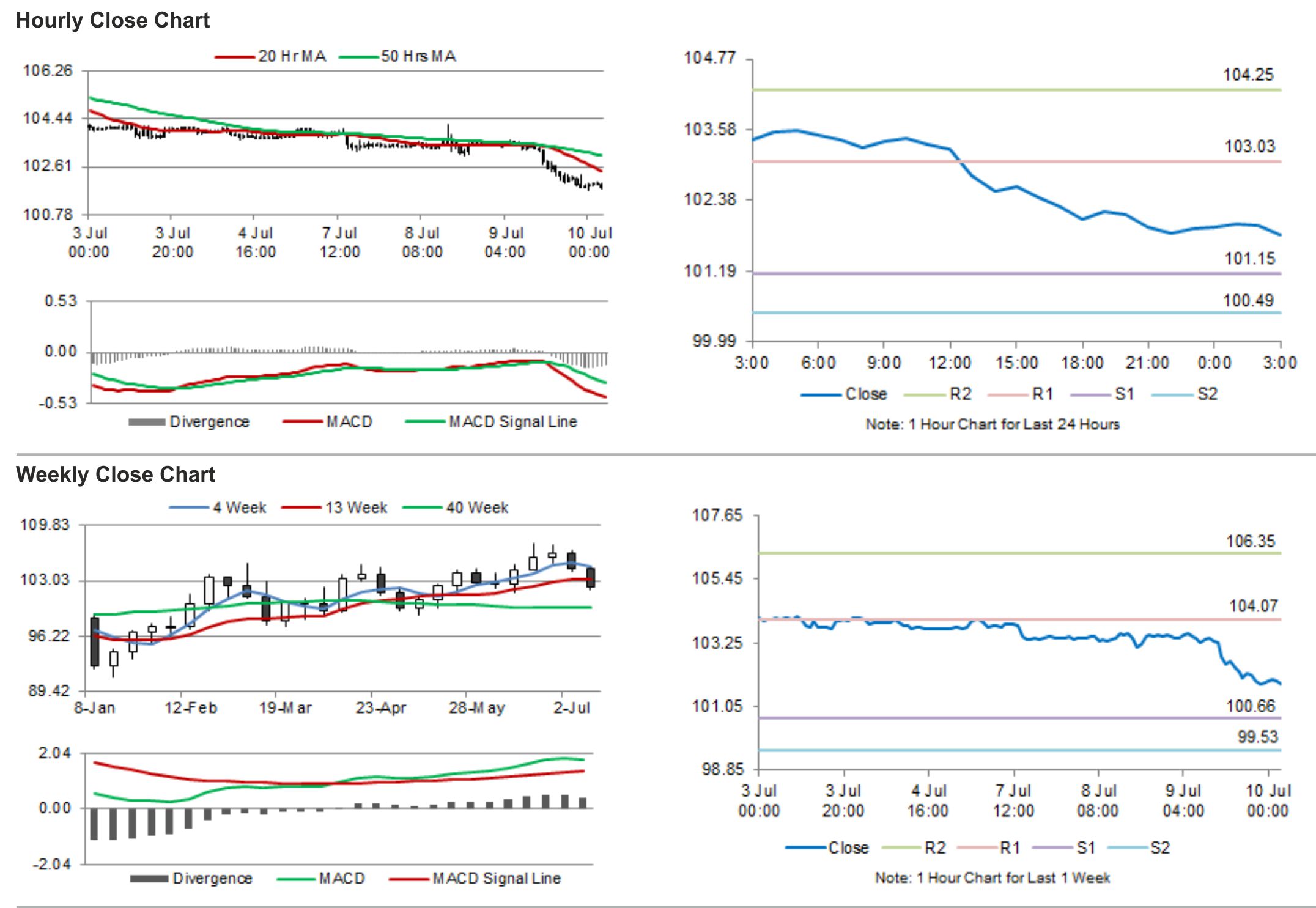

Crude oil is expected to find support at 101.15, and a fall through could take it to the next support level of 100.49. Crude oil is expected to find its first resistance at 103.03, and a rise through could take it to the next resistance level of 104.25.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.