Crude Oil prices advanced 0.30% against the USD for the 24 hour period ending 23:00GMT, closing at 93.84, as upbeat economic data from the US more than offset China’s weak factory output and dismal Euro-zone macroeconomic data.

Meanwhile, the API, in its monthly report, mentioned that the US imports of crude fell to a 19-year low for July to 9.06 million barrels per day as domestic crude-oil production rose to the highest level in the same month, since 1986.

In the Asian session, at GMT0300, Crude Oil is trading at 93.86, tad higher from yesterday’s close.

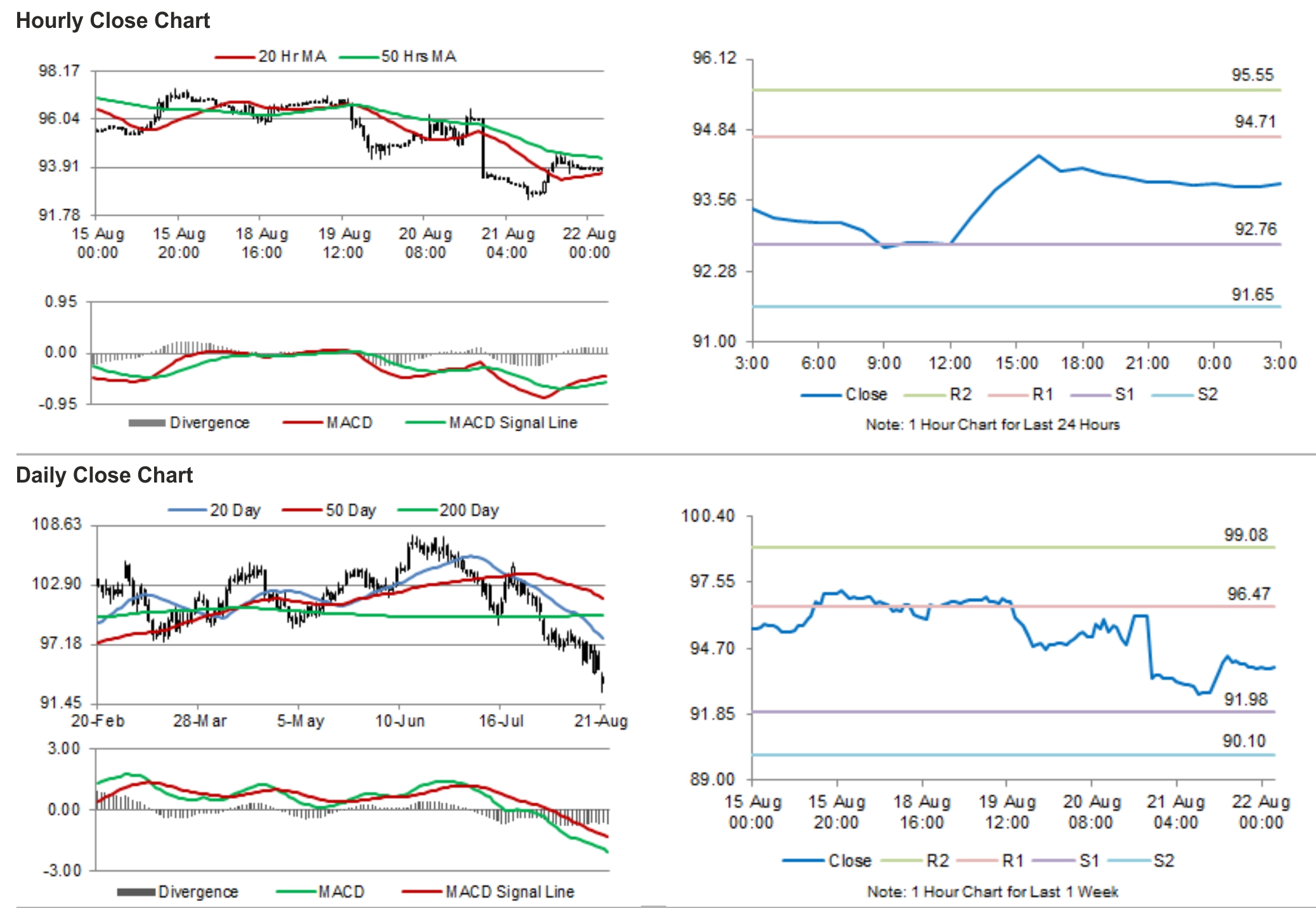

Crude oil is expected to find support at 92.76, and a fall through could take it to the next support level of 91.65. Crude oil is expected to find its first resistance at 94.71, and a rise through could take it to the next resistance level of 95.55.

Crude oil is trading between its 20 Hr and 50 Hr moving averages.