Crude Oil prices advanced 0.98% against the USD for the 24 hour period ending 23:00GMT, closing at 43.13, boosted by a less-than-expected rise in crude-oil inventories and a further decline in the number of U.S. oil rigs.

The Energy Information Administration (EIA) disclosed that US crude-oil stockpiles rose by 961,000 barrels last week, while investors had expected supplies to increase by 1.2 million barrels.

Further, the Baker Hughes report disclosed that the number of working US oil rigs dropped by 9 in the week ended 25 November, bringing the total rig-count to 555, i.e. the least since June 2010.

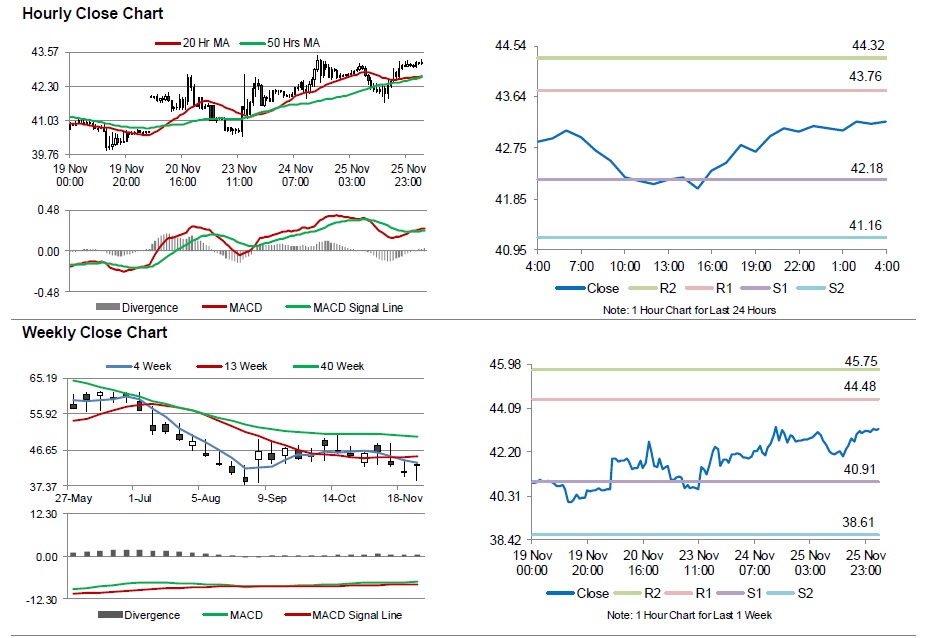

In the Asian session, at GMT0400, the pair is trading at 43.2, with the oil trading 0.16% higher from yesterday’s close.

The pair is expected to find support at 42.18, and a fall through could take it to the next support level of 41.16. The pair is expected to find its first resistance at 43.76, and a rise through could take it to the next resistance level of 44.32.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.