For the 24 hours to 23:00 GMT, Crude Oil declined 0.11% against the USD and closed at USD56.76 per barrel, after the Energy Information Administration (EIA) forecasted that US shale oil production would rise by 80,000 barrels per day (bpd) in December.

Separately, the Organisation of the Petroleum Exporting Countries (OPEC) projected higher demand for oil in 2018 and signalled that global oil market could rebalance at a faster pace next year.

The OPEC, in a monthly report, stated that its oil demand would increase by 400,000 bpd to 33.4 million bpd in 2018.

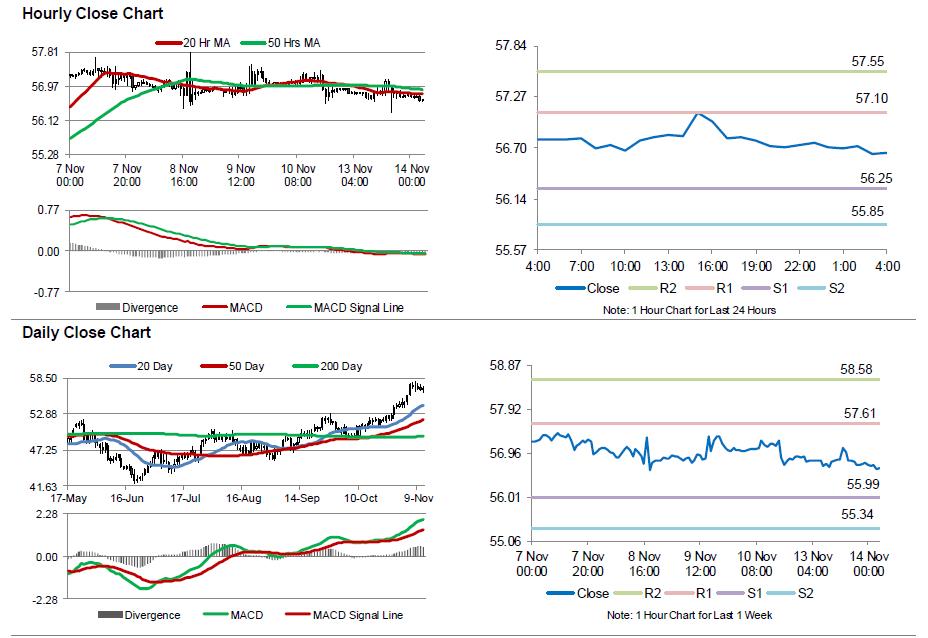

In the Asian session, at GMT0400, the pair is trading at 56.65, with the oil trading 0.19% lower against the USD from yesterday’s close, ahead of the American Petroleum Institute’s weekly crude inventories data.

The pair is expected to find support at 56.25, and a fall through could take it to the next support level of 55.85. The pair is expected to find its first resistance at 57.1, and a rise through could take it to the next resistance level of 57.55.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.