For the 24 hours to 23:00 GMT, Crude Oil declined 0.47% against the USD and closed at USD63.75 per barrel, following a bearish report from the Energy Information Administration (EIA) and the Organisation of Petroleum Exporting Countries (OPEC).

The EIA indicated that US crude production rose to 9.75 million barrels a day (bpd), up from 9.49 million bpd last week. Moreover, the OPEC, in its monthly report, forecasted that non-OPEC member countries would boost supply by 1.15 million barrels per day (bpd) this year, up from 990,000 bpd expected previously, as higher crude prices would encourage non-OPEC members to pump more oil.

Separately, the EIA disclosed that US crude stockpiles fell 6.9 million barrels to 412.7 million barrels in the week ended 12 January.

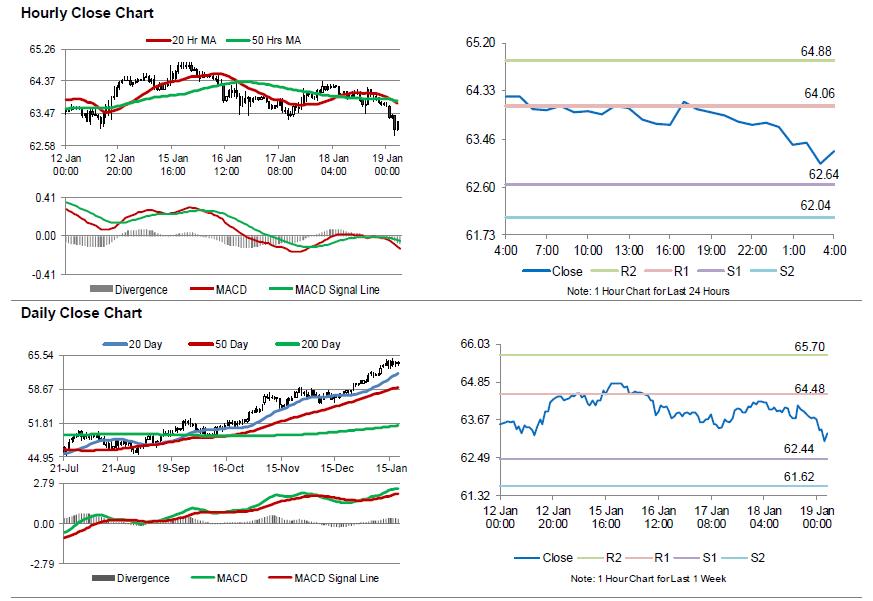

In the Asian session, at GMT0400, the pair is trading at 63.25, with oil trading 0.78% lower against the USD from yesterday’s close.

The pair is expected to find support at 62.64, and a fall through could take it to the next support level of 62.04. The pair is expected to find its first resistance at 64.06, and a rise through could take it to the next resistance level of 64.88.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.