For the 24 hours to 23:00 GMT, Crude Oil declined 2.72% against the USD and closed at USD54.29 per barrel on Friday, amid rising concerns that China’s coronavirus might spread to other countries, thus curbing travel and oil demand. Moreover, Baker Hughes reported that the number of active US oil drilling rigs rose by 3 to 676 for the week ended 24 January.

In the Asian session, at GMT0400, the pair is trading at 52.95, with oil trading 2.47% lower against the USD from Friday’s close, as the rising number of cases of the new coronavirus in China and city lockdowns in the country deepened concerns over oil demand from the world’s second-largest oil consumer. Meanwhile, Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman Al-Saud, stated that he was following developments in China and added that he felt confident the new virus would be contained.

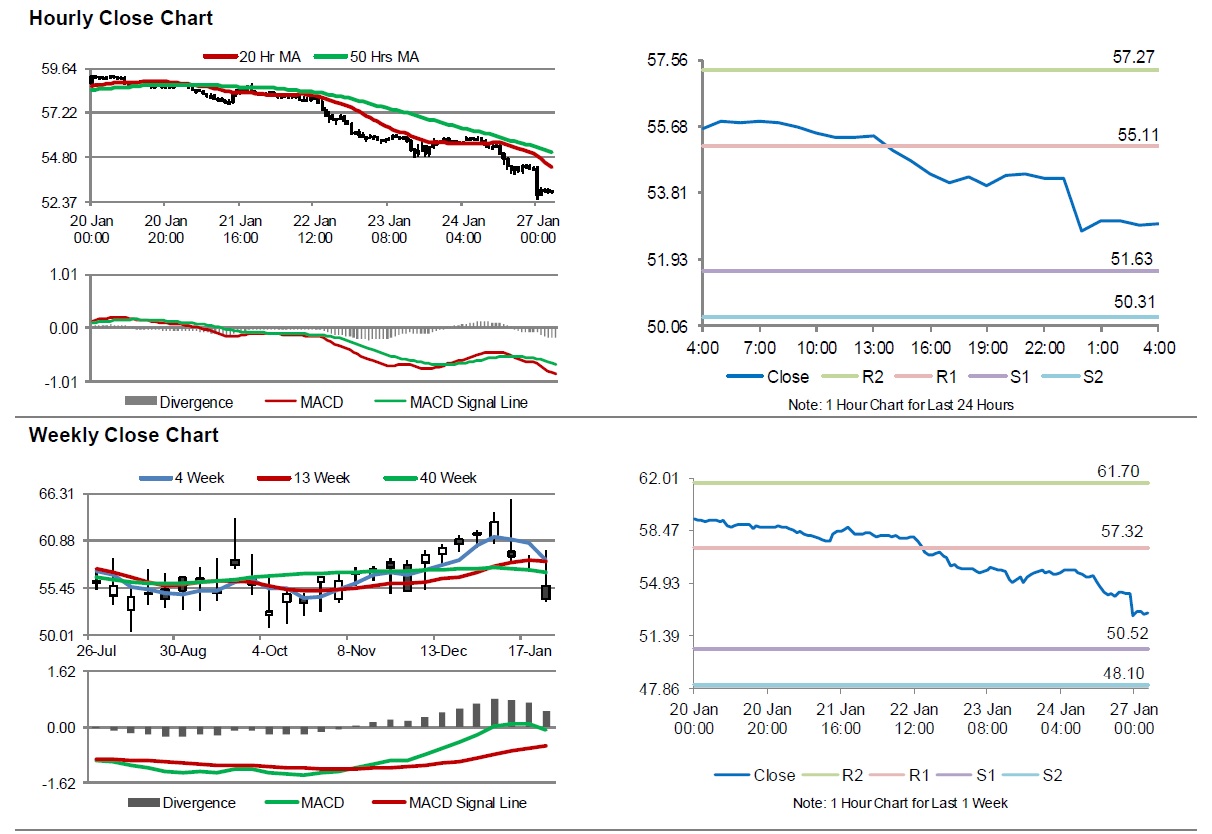

The pair is expected to find support at 51.63, and a fall through could take it to the next support level of 50.31. The pair is expected to find its first resistance at 55.11, and a rise through could take it to the next resistance level of 57.27.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.