For the 24 hours to 23:00 GMT, Crude Oil declined 5.09% against the USD and closed at USD 23.66 per barrel on Friday, as economic stimulus plans from government worldwide failed to ease concerns about the economic impact of coronavirus on oil demand and as Saudi Arabia and Russia oversupplied the market. Separately, Baker Hughes reported that US oil rig count fell by 19 to 664 last week.

In the Asian session, at GMT0400, the pair is trading at 22.71, with oil trading 4.02% lower against the USD from Friday’s close.

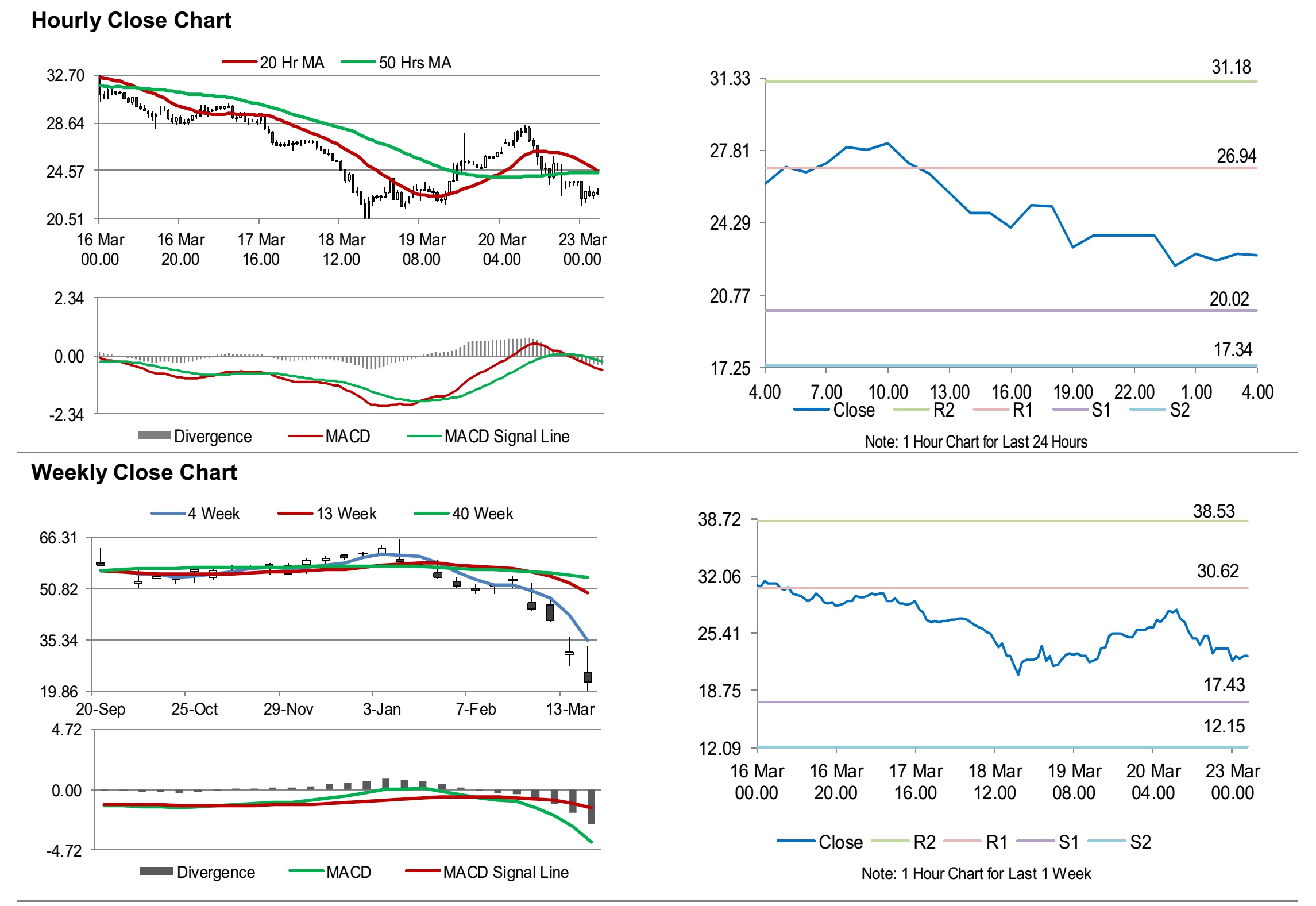

The pair is expected to find support at 20.02, and a fall through could take it to the next support level of 17.34. The pair is expected to find its first resistance at 26.94, and a rise through could take it to the next resistance level of 31.18.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.