Crude Oil prices declined 2.39% against the USD for the 24 hour period ending 23:00GMT, closing at 46.54, reversing its previous session gains, after the Energy Information Administration (EIA) reported a strong build-up in US crude inventories.

Yesterday, the EIA disclosed that US crude-oil stockpiles rose by 2.85 million barrels last week to 482.81 million barrels, marking the sixth consecutive week of increases. Investors had expected supplies to increase by 2.5 million barrels.

Moreover, an OPEC report projected that global oil demand will remain weak for the next few years, further weighed on oil prices.

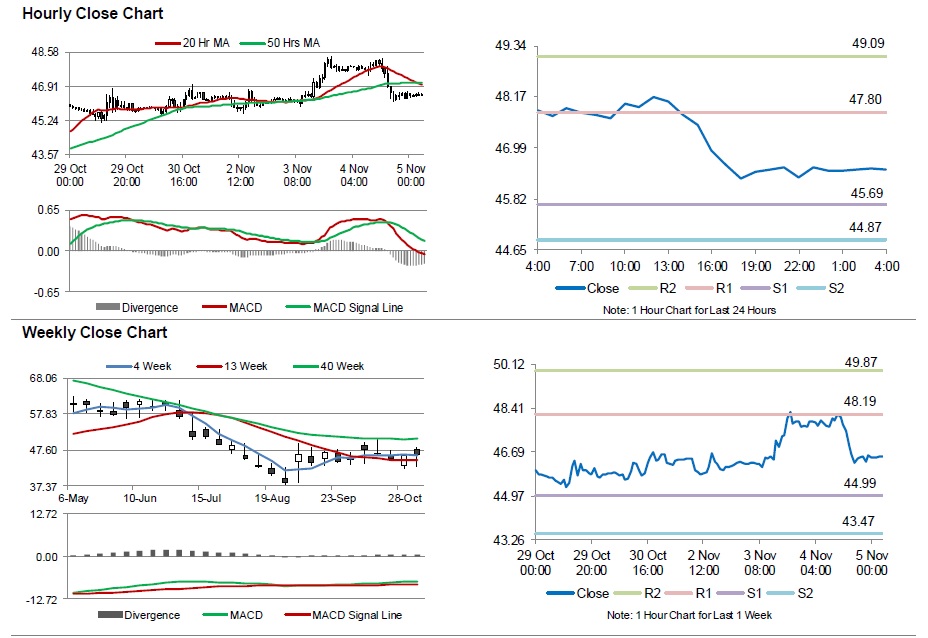

In the Asian session, at GMT0400, the pair is trading at 46.5, with the oil trading marginally lower from yesterday’s close.

The pair is expected to find support at 45.69, and a fall through could take it to the next support level of 44.87. The pair is expected to find its first resistance at 47.80, and a rise through could take it to the next resistance level of 49.09.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.