Crude Oil prices advanced 1.19% against the USD for the 24 hour period ending 23:00GMT, closing at 101.41, after the US Energy Information Administration reported that US crude oil inventories fell by 7.5 million barrels during the week ended 11 July. Oil prices were also boosted after China’s economy grew higher than market expectations. Additionally, another data revealed that supplies at Cushing, Oklahoma, the largest oil-storage hub and the delivery point for WTI crude in the US tumbled by 650,000 barrels to 20.3 million in the week ended 11 July.

Meanwhile, a leading broker has projected Brent crude prices to go down over the next five years, as global supplies would increase considerably.

In the Asian session, at GMT0300, Crude Oil is trading at 101.47, 0.06% higher from yesterday’s close.

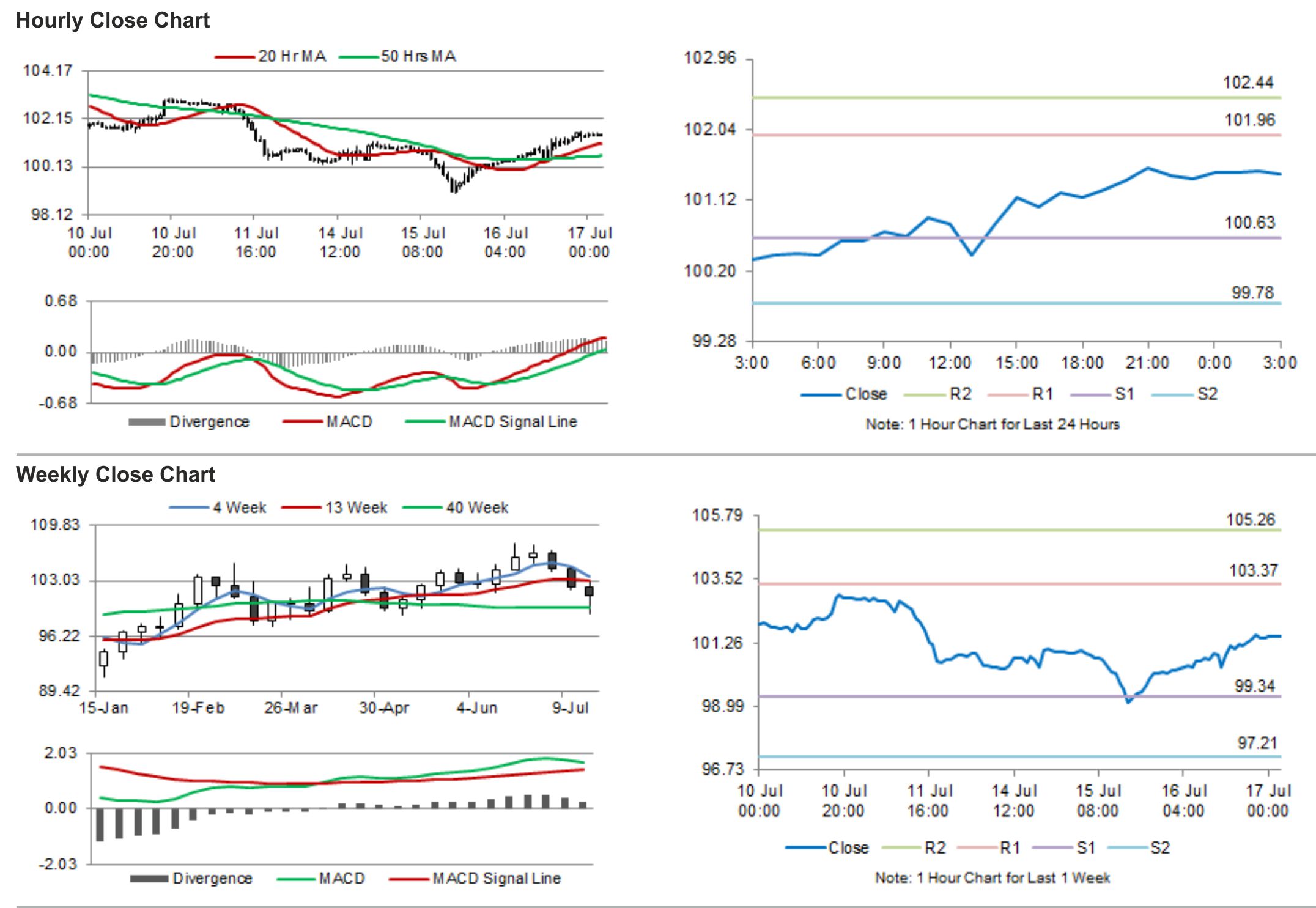

Crude oil is expected to find support at 100.63, and a fall through could take it to the next support level of 99.78. Crude oil is expected to find its first resistance at 101.96, and a rise through could take it to the next resistance level of 102.44.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.