Crude Oil prices declined 0.27% against the USD for the 24 hour period ending 23:00GMT, closing at 101.51, as excess supplies from North Sea and West Africa and weak demand from Europe and Asia overshadowed fears of escalating tensions in Ukraine and the Middle East. Data revealed that the crude oil cargoes for immediate lifting from the North Sea are trading at deep discounts to later ones, while 30 million unsold barrels of West African crude for lifting in August, and September cargoes were already becoming available, further weighing the market.

However, losses were trimmed after news emerged yesterday that the US and the EU decided to go ahead with further sanctions on Russia. Additionally, unrest in the Middle East intensified after Israel warned Gaza residents to evacuate after Palestinian fighters launched a cross-border raid. Moreover, other data indicated that the oil production from Libya dropped 20% to around 450,000 barrels per day, as violence failed to recede in Tripoli.

In the Asian session, at GMT0300, Crude Oil is trading at 101.56, tad higher from yesterday’s close.

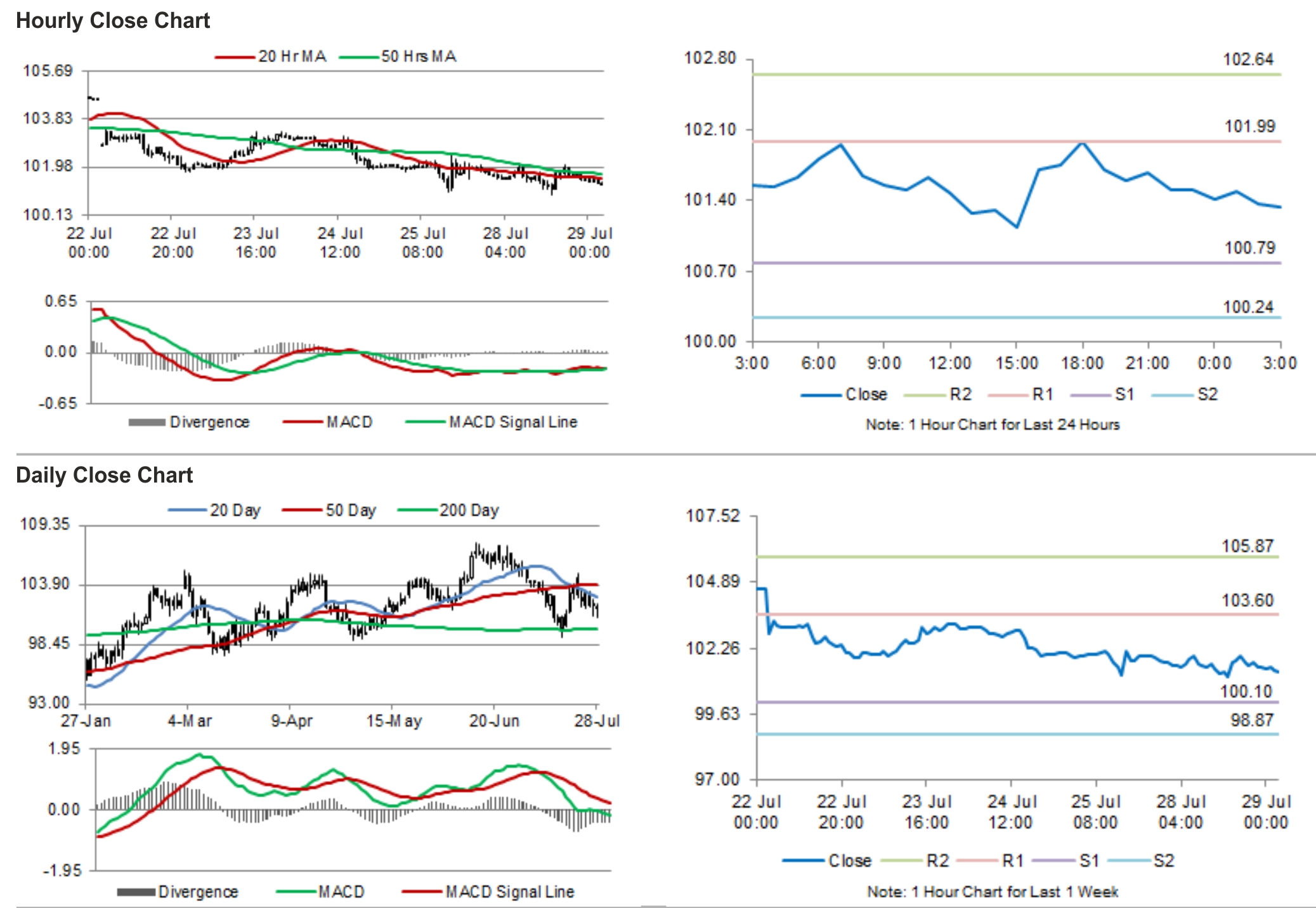

Crude oil is expected to find support at 100.79, and a fall through could take it to the next support level of 100.24. Crude oil is expected to find its first resistance at 101.99, and a rise through could take it to the next resistance level of 102.64.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.