Crude Oil prices declined 0.51% against the USD for the 24 hour period ending 23:00GMT, closing at 100.99 as a firm dollar weighed on the demand for commodities as an alternative investment. The oil prices also came under pressure after concerns arose that CVR Refining’s decision to shut down its 115,000-barrel-a-day refinery in Coffeyville, Kansas, on account of a fire, would result in a glut of inventories at Cushing, Oklahoma, the delivery point for WTI futures and from where it gets its supply.

Yesterday, the American Petroleum Institute reported that the US crude stockpiles unexpectedly declined by 4.4-million-barrels in the week ended 25 July to 369.4 million, compared to analysts’ expectations for a decrease of 1.5 million barrels.

In the Asian session, at GMT0300, Crude Oil is trading at 101.00, slightly higher from yesterday’s close.

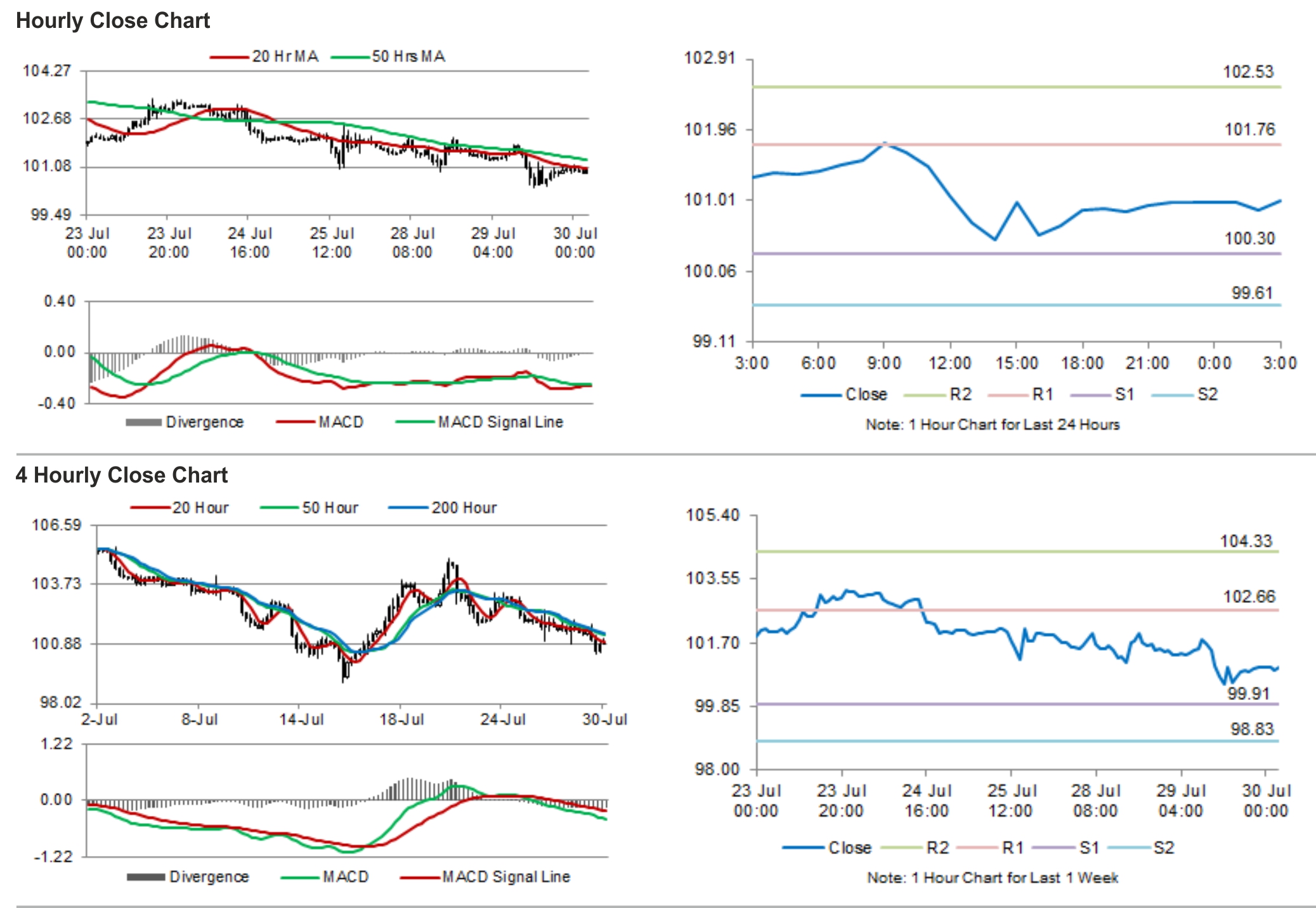

Crude oil is expected to find support at 100.30, and a fall through could take it to the next support level of 99.61. Crude oil is expected to find its first resistance at 101.76, and a rise through could take it to the next resistance level of 102.53.

Crude oil is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.