For the 24 hours to 23:00 GMT, Crude Oil rose 0.87% against the USD and closed at USD71.10 per barrel, after the Organisation of the Petroleum Exporting Countries (OPEC), in its monthly report, revised up its demand forecast for global crude oil by 25000 barrels to 98.85 barrels per day (bpd). Further, the OPEC stated that the global oil glut has been nearly eliminated. However, the report showed that OPEC’s crude production rose by 12,000 bpd in April, driven by an increase in output from Saudi Arabia.

Separately, the Energy Information Administration (EIA) estimated that crude-oil production from seven major US shale players would rise by 144,000 bpd in June to 7.18 million bpd.

In the Asian session, at GMT0300, the pair is trading at 70.98, with oil trading 0.17% lower against the USD from yesterday’s close.

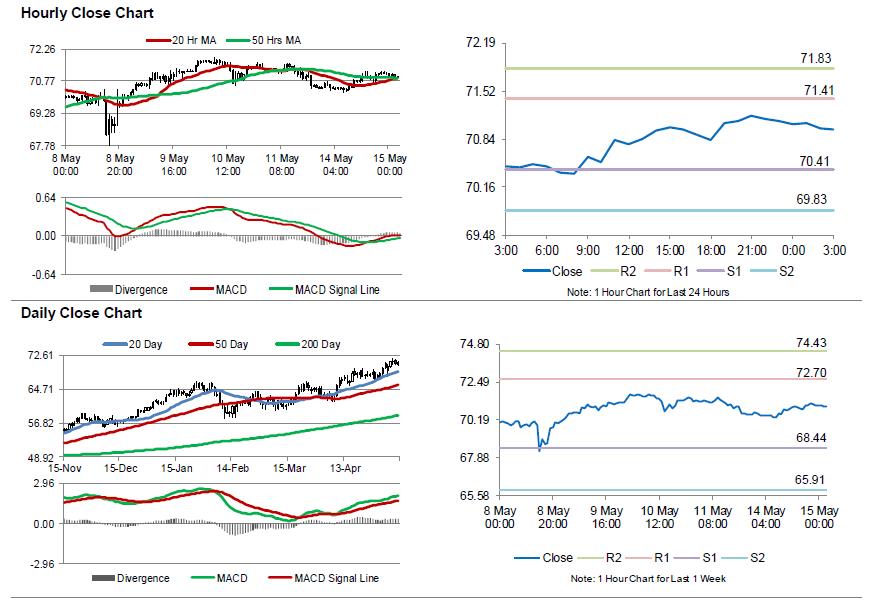

The pair is expected to find support at 70.41, and a fall through could take it to the next support level of 69.83. The pair is expected to find its first resistance at 71.41, and a rise through could take it to the next resistance level of 71.83.

Crude oil is showing convergence with its 20 Hr and 50 Hr moving averages.