Crude Oil prices declined 0.51% against the USD for the 24 hour period ending 23:00GMT, closing at 80.68, after the US reported weaker pending home sales data, thus increasing concerns of the demand outlook of the commodity from the world’s biggest consumer of oil.

Yesterday, Mohsen Qamsari, a director for international affairs at National Iranian Oil Co stated that the chances that the OPEC would slash its production ceiling at its November meeting were very less.

In the Asian session, at GMT0400, the pair is trading at 80.69, with the oil trading marginally higher from yesterday’s close.

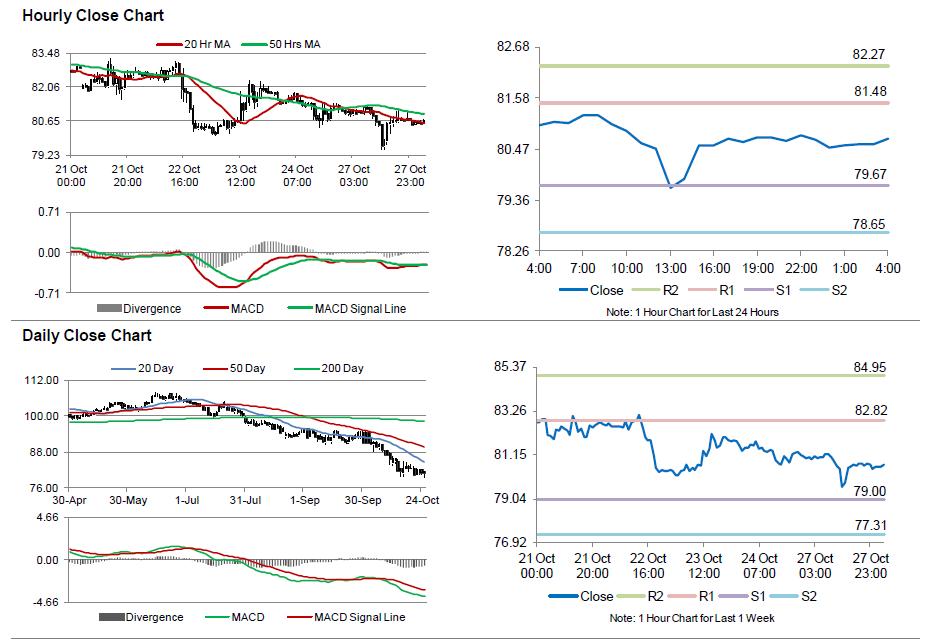

The pair is expected to find support at 79.67, and a fall through could take it to the next support level of 78.65. The pair is expected to find its first resistance at 81.48, and a rise through could take it to the next resistance level of 82.27.

Crude oil is trading between its 20 Hr and 50 Hr moving averages.