For the 24 hours to 23:00 GMT, Crude Oil declined 0.83% against the USD and closed at USD43.22 per barrel on Friday, as reports of swelling Iranian exports reinforced fears of a global supply glut

Additionally, Baker Hughes disclosed that the number of active US oil rigs rose by 2 during the week ended 16 September, bringing the total rig count up to 416, the highest since February 2016.

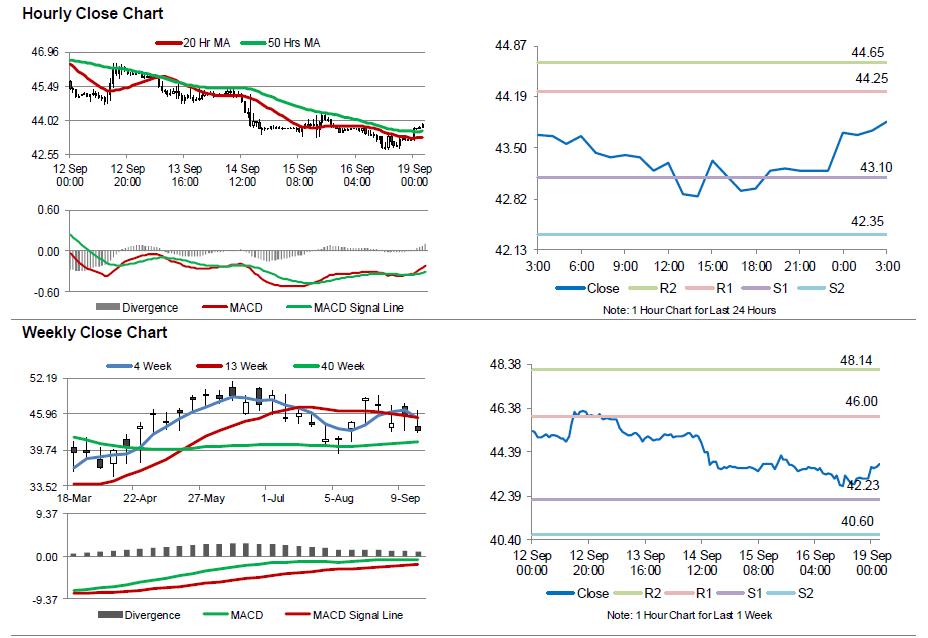

In the Asian session, at GMT0300, the pair is trading at 43.86, with the oil trading 1.48% higher from Friday’s close, amid speculation that the OPEC and non-OPEC countries were close to reaching an output stabilising deal.

The pair is expected to find support at 43.10, and a fall through could take it to the next support level of 42.35. The pair is expected to find its first resistance at 44.25, and a rise through could take it to the next resistance level of 44.65.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.