Oil prices advanced 2.48% against the USD for the 24 hour period ending 23:00GMT, closing at 108.54, on speculation that demand for oil might rise following strong economic data from the US and Germany.

Concerns that Iran’s output may be affected by geopolitical issues also buoyed oil prices. Yesterday, Director of external relations at the IMF, Gerry Rice, stated that a halt of Iran’s oil exports to the Organization for Economic Cooperation and Development countries could trigger a 20% to 30% jump in prices.

Additionally, oil prices were supported by reports showing smaller-than-expected rise in the US crude oil inventories. The Energy Information Administration (EIA) reported that the US crude stockpiles climbed 1.6 million barrels for the week ended 17 February. Gasoline supplies declined 600,000 barrels, while distillates fell 200,000 barrels.

In the Asian session, at GMT0400, Crude Oil is trading at 108.49, 0.05% lower from yesterday’s close.

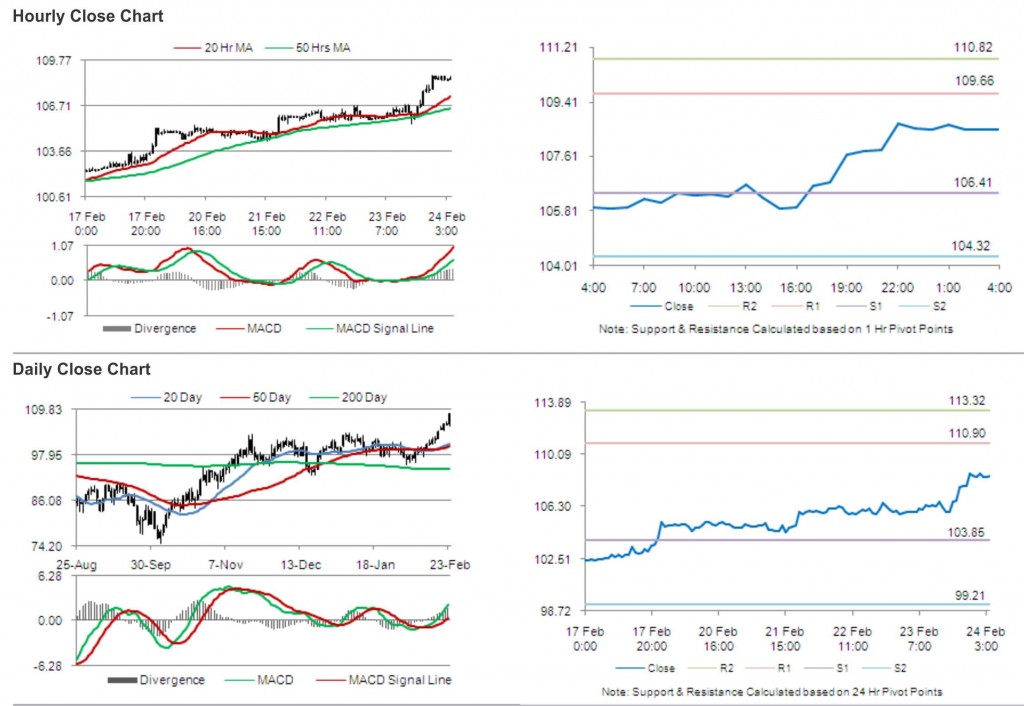

Crude oil is expected to find support at 106.41, and a fall through could take it to the next support level of 104.32. Crude oil is expected to find its first resistance at 109.66, and a rise through could take it to the next resistance level of 110.82.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.