For the 24 hours to 23:00 GMT, Crude Oil declined 1.72% against the USD and closed at USD43.46, as news of boosted crude supply by several key producers intensified global supply glut concerns.

However, losses in crude prices were trimmed, after the American Petroleum Institute (API) indicated that US crude oil inventories fell by 2.7 million barrels to 508.7 million barrels in the week ended 16 June.

In the Asian session, at GMT0300, the pair is trading at 43.44, with the oil trading marginally lower against the USD from yesterday’s close.

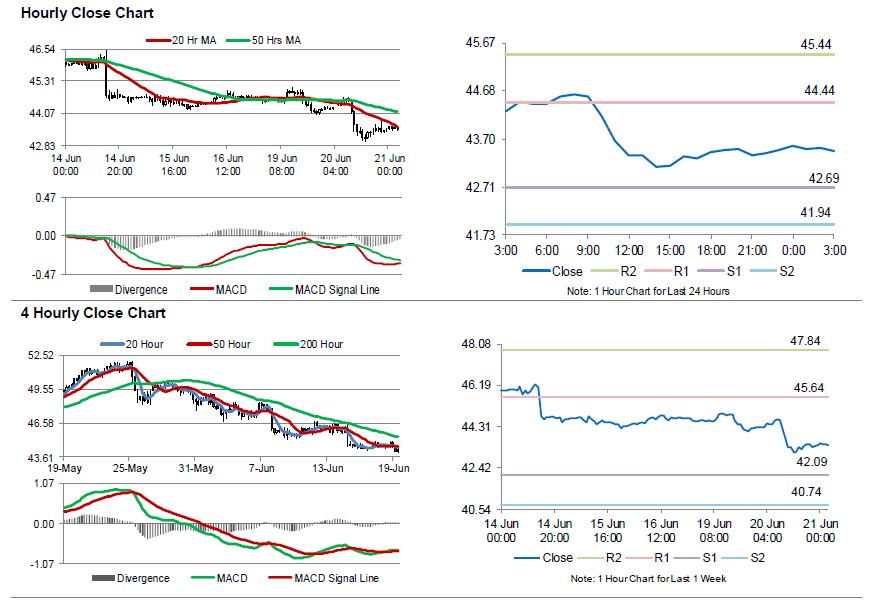

The pair is expected to find support at 42.69, and a fall through could take it to the next support level of 41.94. The pair is expected to find its first resistance at 44.44, and a rise through could take it to the next resistance level of 45.44.

Crude oil is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.