Crude Oil prices advanced 2.96% against the USD for the 24 hour period ending 23:00GMT, closing at 83.10, as industrial production in the US rebounded strongly in September, thereby increasing the demand outlook of the commodity from the world’s biggest consumer of oil.

Meanwhile, the Energy Information Administration (EIA) reported that the US crude oil inventories rose by 8.9 million barrels to 370.6 million barrels, exceeding market forecasts for a gain of 2.8 million barrels in the week ended October 10.

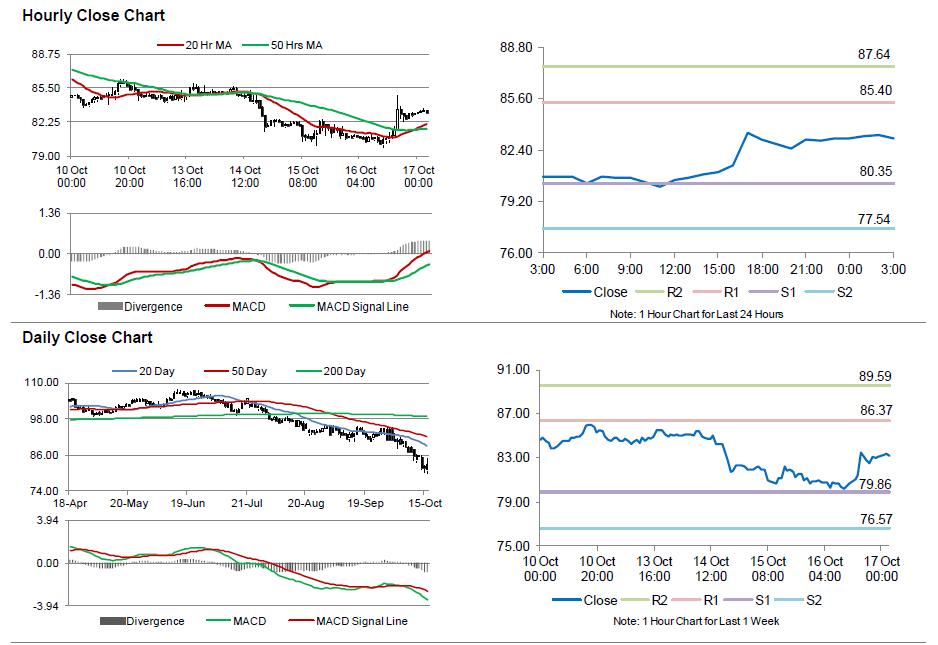

In the Asian session, at GMT0300, the pair is trading at 83.16, with oil trading 0.07% higher from yesterday’s close.

The pair is expected to find support at 80.35, and a fall through could take it to the next support level of 77.54. The pair is expected to find its first resistance at 85.4, and a rise through could take it to the next resistance level of 87.64.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.