Crude Oil prices declined 3.62% against the USD for the 24 hour period ending 23:00GMT, closing at 44.77, as manufacturing activity in China slowed down to more than a six-year low in September, thus pointing towards slower economic recovery in China and weaker demand prospects for the commodity from the world’s second biggest consumer of oil.

Oil prices failed to find support, despite the Energy Information Administration (EIA) disclosing a drop in US crude oil inventories of 1.9 million barrels to 454.0 million barrels, against an expected decline of 0.7 million barrels in the week ended 18 September.

In the Asian session, at GMT0300, the pair is trading at 44.87, with the oil trading 0.22% higher from yesterday’s close.

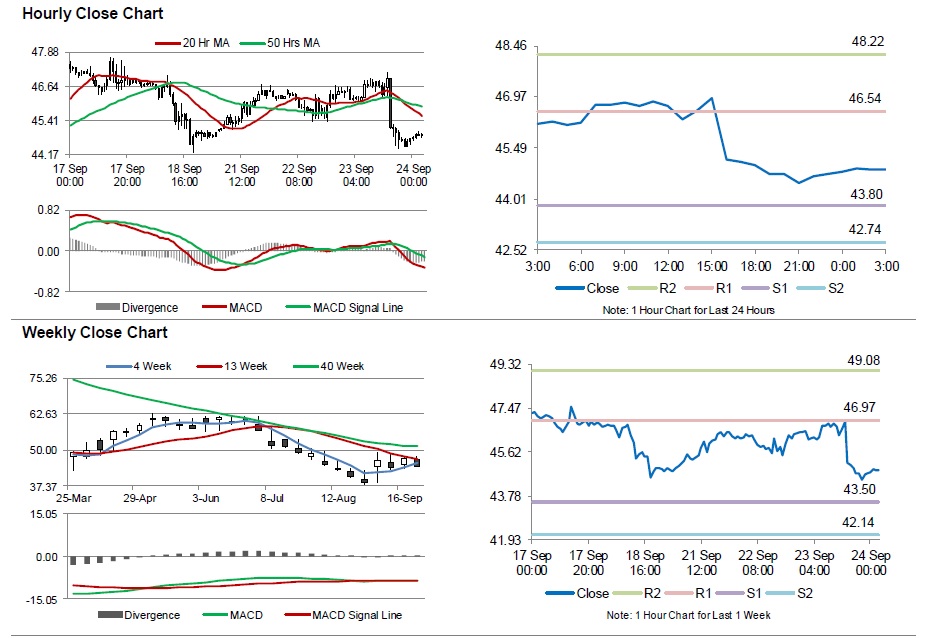

The pair is expected to find support at 43.80, and a fall through could take it to the next support level of 42.73. The pair is expected to find its first resistance at 46.54, and a rise through could take it to the next resistance level of 48.21.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.