Crude Oil prices declined 2.84% against the USD for the 24 hour period ending 23:00GMT, closing at 80.38, after the Energy Information Administration (EIA) in its weekly oil report showed that the US crude stockpiles increased 7.1 million barrels to 377.7 million barrels, against an anticipated gain of 2.7 million barrels in the week ended October 17.

Yesterday, Libya’s OPEC Governor Samir Kamal indicated that the OPEC cartel should decrease its oil production by almost 500,000 barrels a day, as the market is already over supplied.

In the Asian session, at GMT0300, the pair is trading at 80.17, with the oil trading 0.26% lower from yesterday’s close.

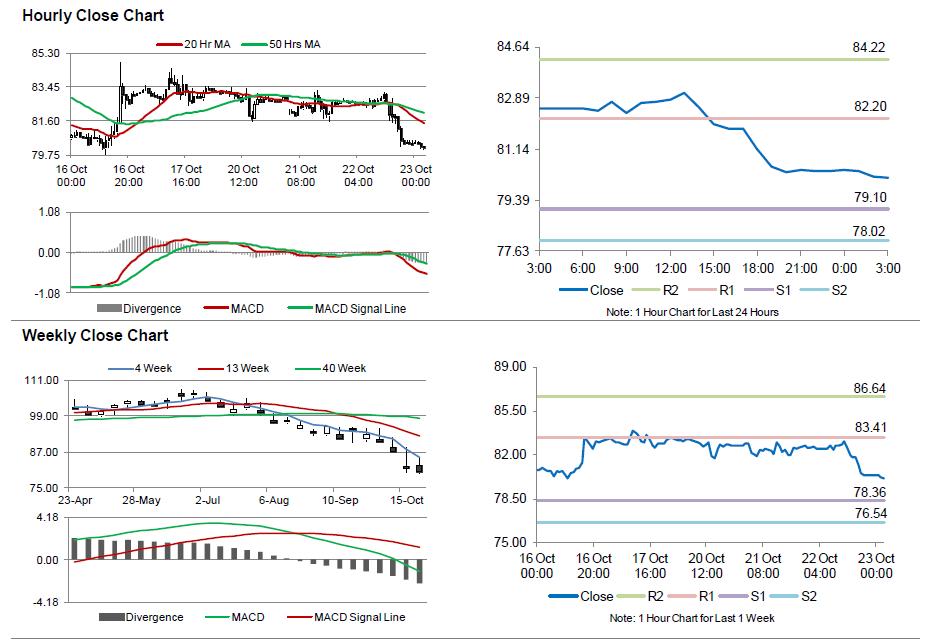

The pair is expected to find support at 79.09, and a fall through could take it to the next support level of 78.02. The pair is expected to find its first resistance at 82.19, and a rise through could take it to the next resistance level of 84.22.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.