Crude Oil prices declined 1.28% against the USD for the 24 hour period ending 23:00GMT, closing at 80.96, following bullishness in the dollar and after reports indicated that the Organization of Petroleum Exporting Countries (OPEC) increased its oil output to a 14-month high in October, amid ample supplies and a weakening global demand. However, losses in oil prices were reduced after the US reported positive GDP data, thereby increasing the demand outlook of the commodity from the world’s biggest consumer of oil.

In the Asian session, at GMT0400, the pair is trading at 80.83, with the oil trading 0.16% lower from yesterday’s close.

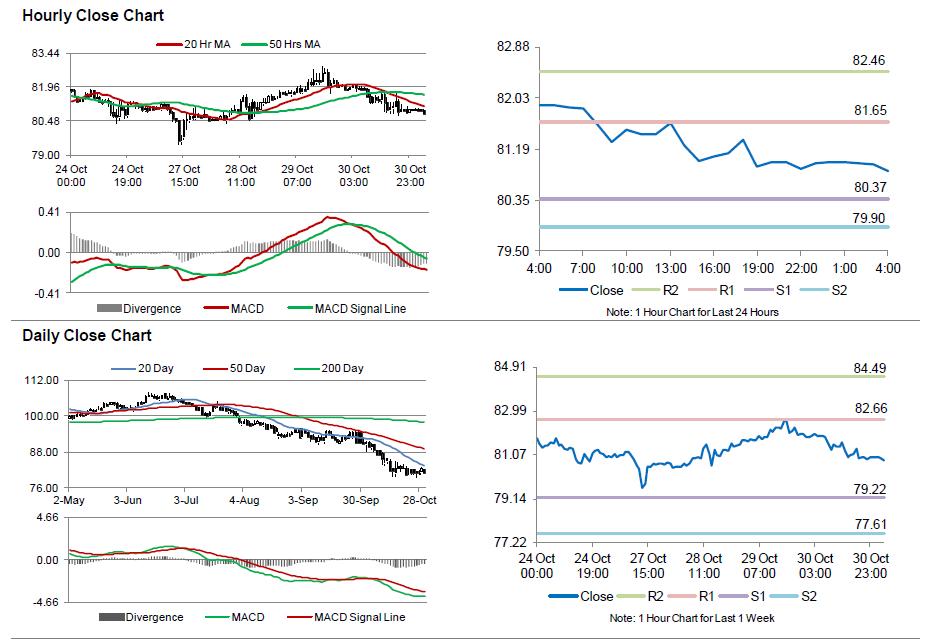

The pair is expected to find support at 80.37, and a fall through could take it to the next support level of 79.90. The pair is expected to find its first resistance at 81.64, and a rise through could take it to the next resistance level of 82.46.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.