On Friday, Crude Oil prices declined 1.07% against the USD for the period ending 21:00GMT, closing at 48.18, as global supply concerns continued to worry the oil market.

Oil prices further came under pressure, after China once again reported dismal manufacturing PMI data, thus increasing the demand growth concerns of the commodity from the world’s biggest consumer of oil.

Meanwhile, data from Baker Hughes Incorporation disclosed that the number of US rigs actively drilling for oil increased by 21 units to 659 rigs in the week ended 24 July.

In the Asian session, at GMT0300, the pair is trading at 47.97, with the oil trading 0.44% lower from Friday’s close.

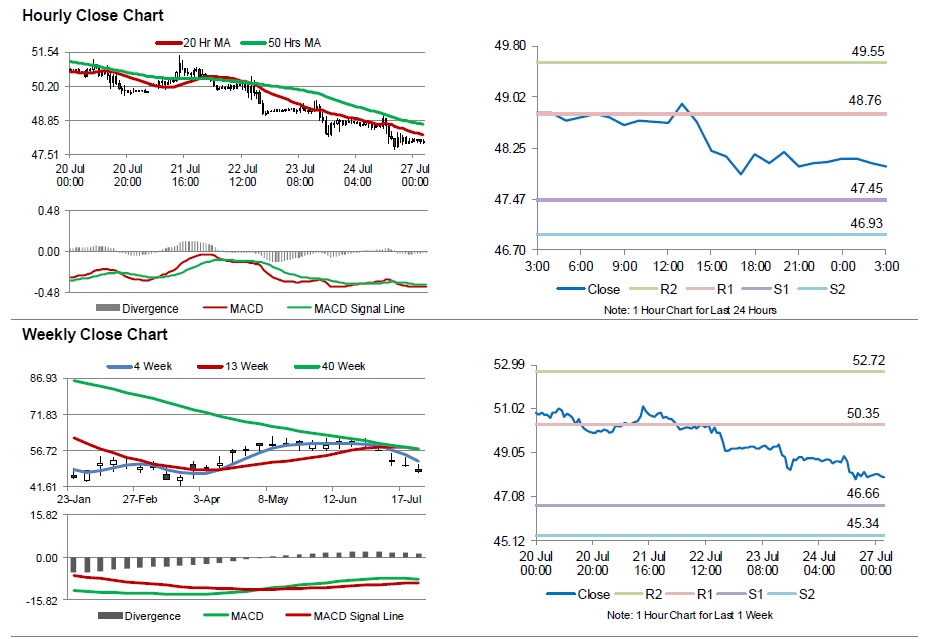

The pair is expected to find support at 47.45, and a fall through could take it to the next support level of 46.93. The pair is expected to find its first resistance at 48.76, and a rise through could take it to the next resistance level of 49.55.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.