Crude Oil prices declined 0.88% against the USD for the 24 hour period ending 23:00GMT, closing at 93.02, after a report from the OPEC revealed that it might not cut its production target, despite the market already being over-supplied with crude stockpiles.

Furthermore, oil prices came under pressure after the American Petroleum Institute (API) in its monthly report indicated that the US crude oil production rose for the eighth consecutive month and remained above 8.0 million barrels per day since February.

In the Asian session, at GMT0300, the pair is trading at 93.04, with the oil trading tad higher from yesterday’s close.

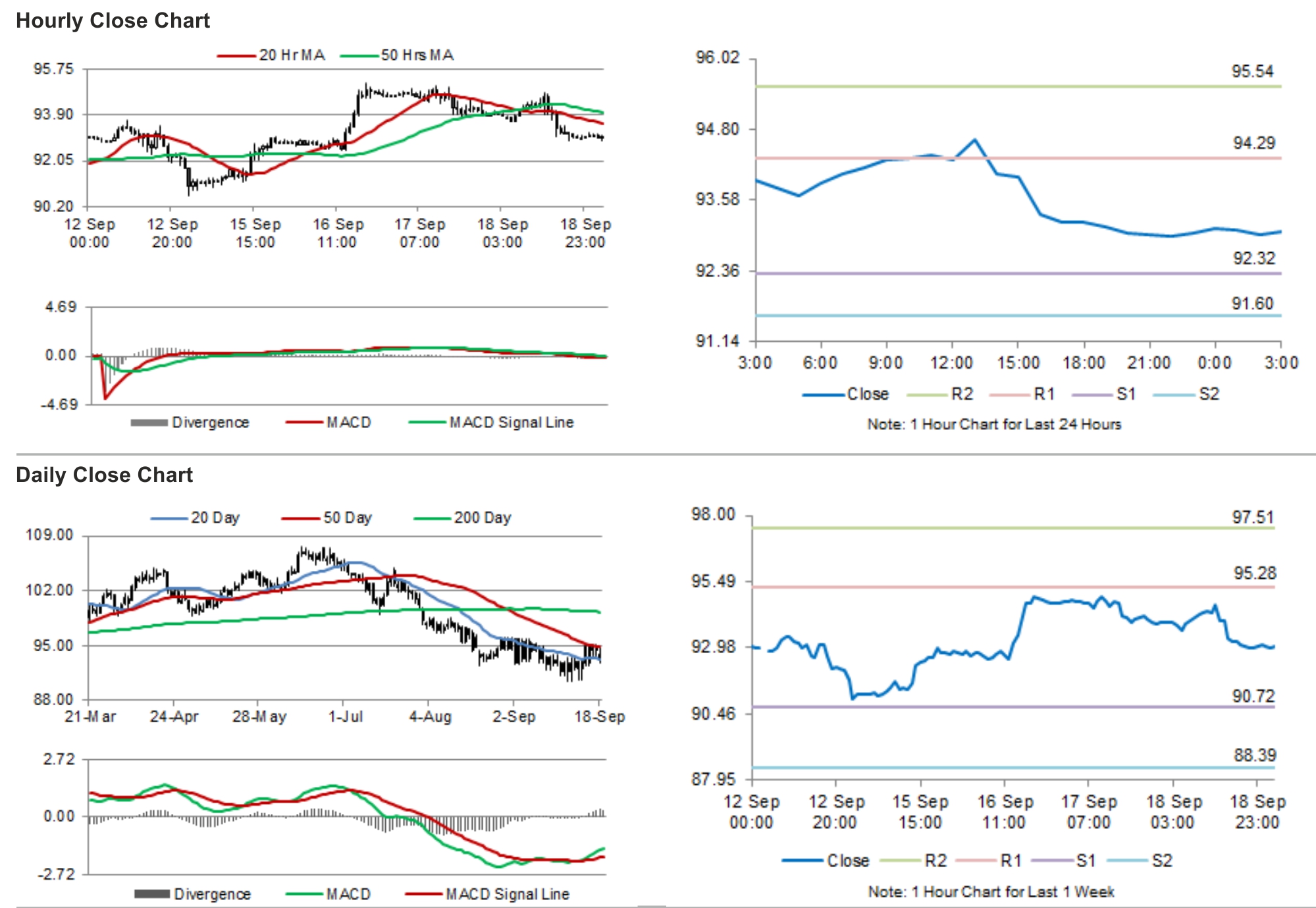

The pair is expected to find support at 92.32, and a fall through could take it to the next support level of 91.6. The pair is expected to find its first resistance at 94.29, and a rise through could take it to the next resistance level of 95.54.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.