For the 24 hours to 23:00 GMT, Crude Oil rose 0.35% against the USD and closed at USD51.06 per barrel, after OPEC raised its crude demand forecast for 2017 & 2018 and added that production-cutting deal was reducing global supply glut.

In its monthly report, the OPEC stated that global oil demand will be 33.06 million barrels per day (bpd) of its crude in 2018, up 230,000 bpd from its previous forecast. Additionally, it stated that crude-oil production in September jumped by 90,000 barrels a day.

Meanwhile, the Energy Information Administration (EIA) noted that it expects US crude oil production in 2018 to rise by 680,000 barrels per day (bpd) to 9.92 million bpd.

Separately, the American Petroleum Institute (API) reported that US crude oil inventories surprisingly rose by 3.1 million barrels to 468.5 million barrels last week.

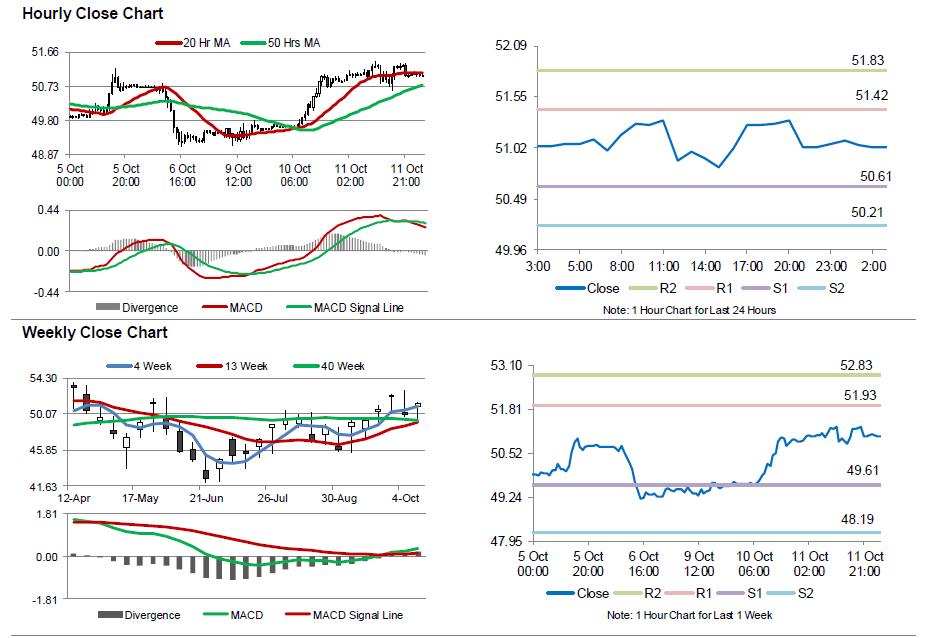

In the Asian session, at GMT0300, the pair is trading at 51.02, with the oil trading 0.08% lower against the USD from yesterday’s close.

The pair is expected to find support at 50.61, and a fall through could take it to the next support level of 50.21. The pair is expected to find its first resistance at 51.42, and a rise through could take it to the next resistance level of 51.83.

Crude oil is trading between its 20 Hr and 50 Hr moving averages.