Crude Oil prices declined 1.68% against the USD for the 24 hour period ending 23:00GMT, closing at 90.86, as demand growth concerns raised after downbeat economic data from the US and following ECB President’s statement that the economic activity in the Euro-zone has slowed.

Meanwhile, oil prices further came under pressure, after China’s Finance Minister, Lou Jiwei, indicated that the Chinese government would not be making any major changes in the nation’s policy.

In the Asian session, at GMT0300, the pair is trading at 91.35, with the oil trading 0.54% higher from yesterday’s close.

China, the second largest consumer of oil, revealed that the manufacturing PMI of the nation rose to 50.5 in September.

Ahead in the day, investors would track the weekly crude oil supply data from the API.

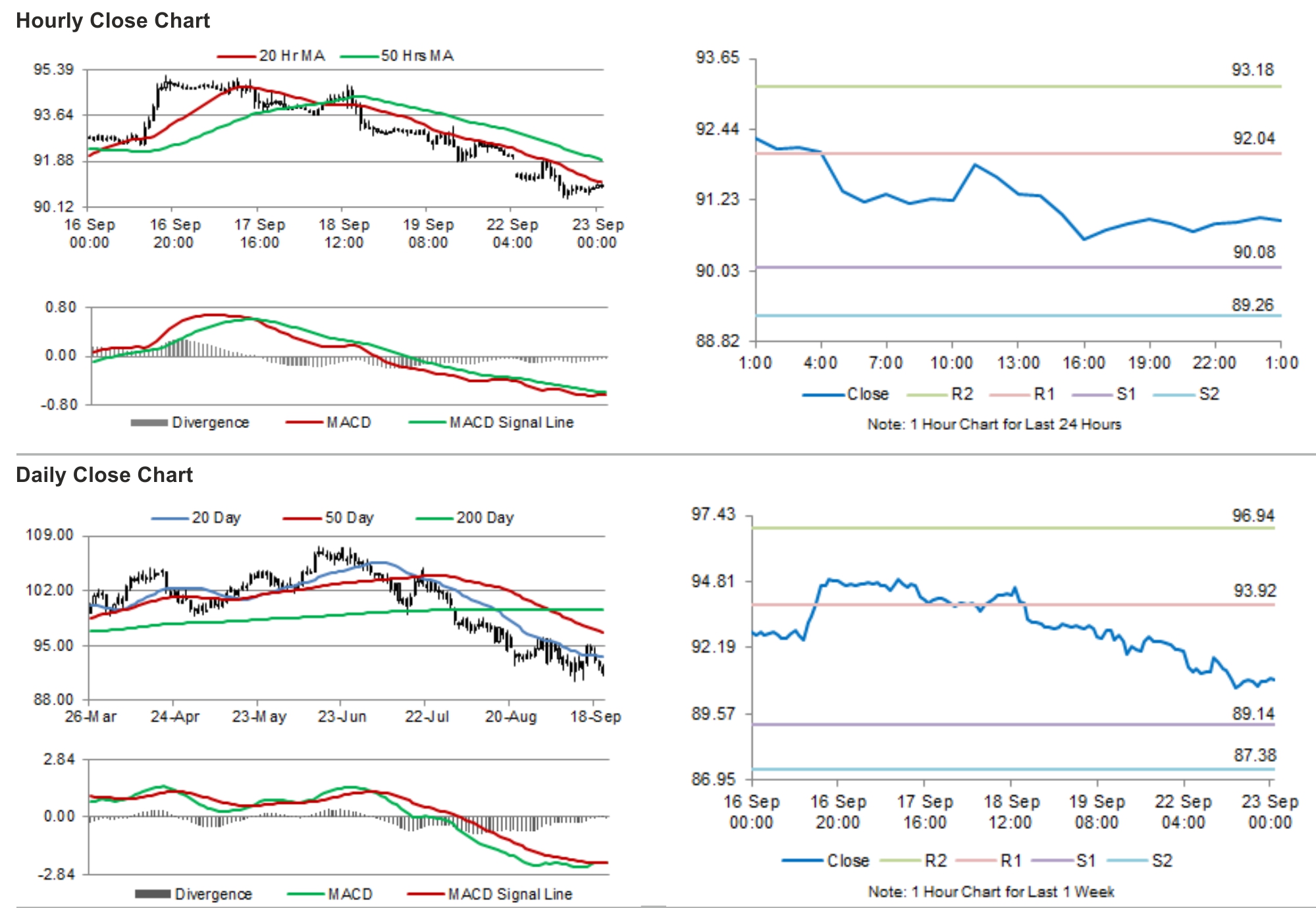

The pair is expected to find support at 90.4533, and a fall through could take it to the next support level of 89.5567. The pair is expected to find its first resistance at 92.2033, and a rise through could take it to the next resistance level of 93.0567.

Crude oil is trading between its 20 Hr and 50 Hr moving averages.