For the 24 hours to 23:00 GMT, Crude Oil rose 1.34% against the USD and closed at USD48.48 per barrel, following severe disruption to Libyan crude oil supplies and the latest comments from OPEC officials suggesting that major oil producers could extend its deal to cut global oil production.

A militia has blocked key pipelines connected to Libyan oil fields, choking off some 250,000 barrels of oil per day.

Separately, the American Petroleum Institute (API) reported a build of 1.91 million barrels in the US crude oil inventories, bringing the total to 535.5 million barrels in the last week.

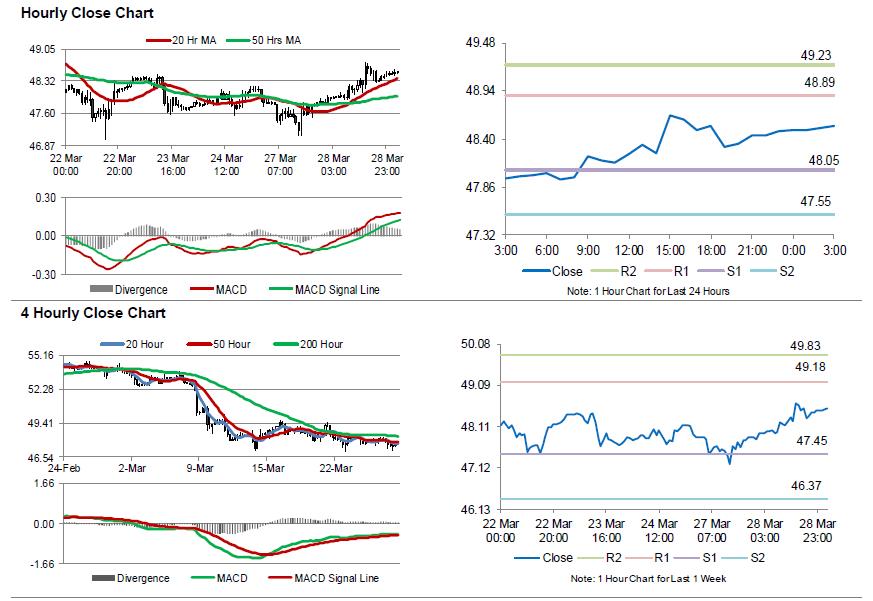

In the Asian session, at GMT0300, the pair is trading at 48.54, with the oil trading 0.12% higher against the USD from yesterday’s close.

The pair is expected to find support at 48.05, and a fall through could take it to the next support level of 47.55. The pair is expected to find its first resistance at 48.89, and a rise through could take it to the next resistance level of 49.23.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.