Crude Oil prices declined 3.87% against the USD for the 24 hour period ending 23:00GMT, closing at 44.51.

However, the commodity pared its losses, after the OPEC’s Secretary-General, Abdalla Salem el-Badri, stated that global investments in oil will fall by $130 billion this year, thus reducing the global supply glut. Additionally, the EIA reported in its monthly outlook that the U.S. crude production declined 1,20,000 barrels a day in September, compared to August, thus reaching its lowest level since September 2014.

Oil prices further found support, after the American Petroleum Institute (API), disclosed that US crude oil stocks unexpectedly narrowed by 1.2 million barrels in the week ended 02 October, against an expected gain of 2.5 million barrels.

In the Asian session, at GMT0300, the pair is trading at 49.10, with the oil trading 10.31% higher from yesterday’s close.

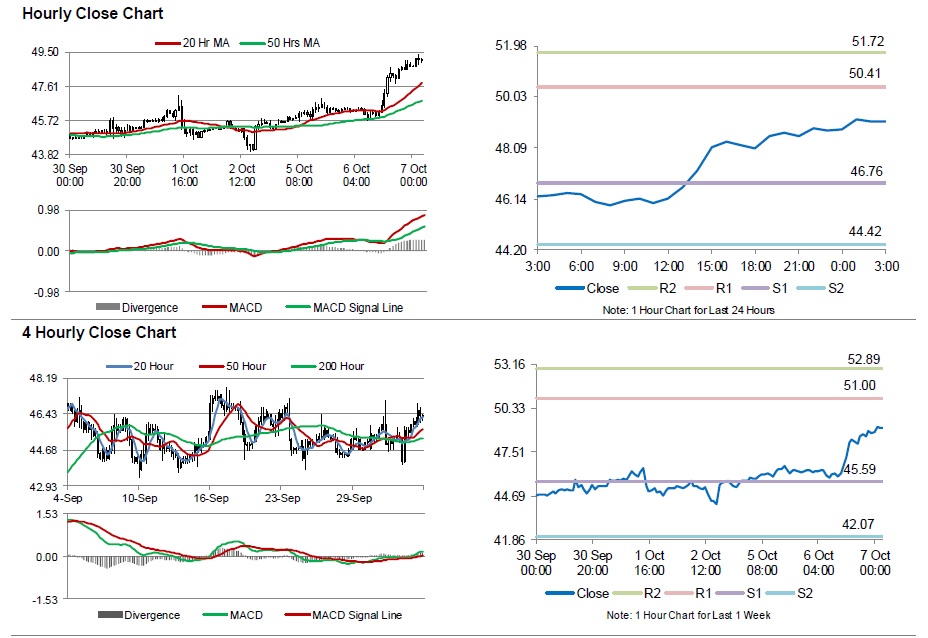

The pair is expected to find support at 46.76, and a fall through could take it to the next support level of 44.42. The pair is expected to find its first resistance at 50.41, and a rise through could take it to the next resistance level of 51.72.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.