For the 24 hours to 23:00 GMT, Crude Oil declined 1.38% against the USD and closed at USD53.42 per barrel, as persistent trade tensions fuelled concerns over weakening energy demand. Separately, the Energy Information Administration (EIA), in its short-term energy outlook, projected that US crude oil output will rise to an average of 12.3 million barrels per day in 2019 and 13.3 million barrels per day in 2020. Meanwhile, the American Petroleum Institute (API) reported that US crude oil inventories fell by 3.4 million barrels in the week ended 02 August.

In the Asian session, at GMT0300, the pair is trading at 53.51, with oil trading 0.17% higher against the USD from yesterday’s close.

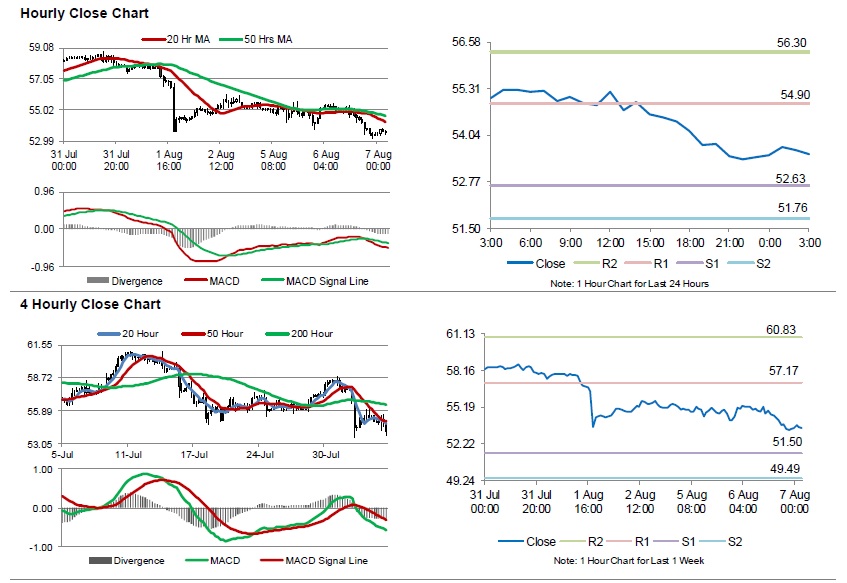

The pair is expected to find support at 52.63, and a fall through could take it to the next support level of 51.76. The pair is expected to find its first resistance at 54.90, and a rise through could take it to the next resistance level of 56.30.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.