For the 24 hours to 23:00 GMT, Crude Oil rose 0.38% against the USD and closed at USD69.16 per barrel, after US re-imposed sanctions against Iran. The US Energy Information Administration lowered its 2019 forecast on the US crude-oil production to 11.7 million barrels per day from 11.8 million barrels per day issued in July. Further, the EIA expects 2018 output at 10.70 million barrels per day, down from 10.79 million barrels projected last month.

In the Asian session, at GMT0300, the pair is trading at 69.24, with oil trading 0.12% higher against the USD from yesterday’s close, after the American Petroleum Institute (API) reported a major drop in US crude oil inventories of 6.0 million barrels to 407.2 million barrels in the week ended 03 August.

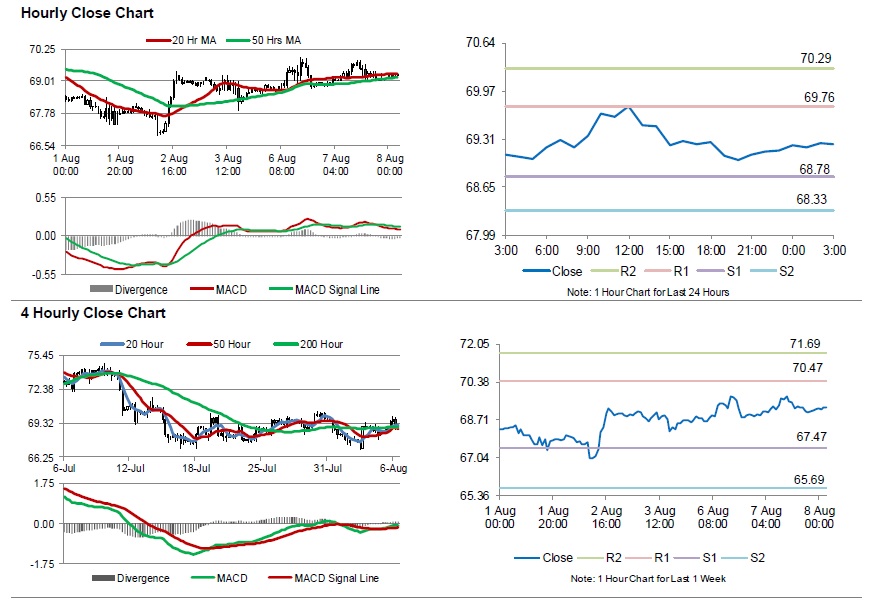

The pair is expected to find support at 68.78, and a fall through could take it to the next support level of 68.33. The pair is expected to find its first resistance at 69.76, and a rise through could take it to the next resistance level of 70.29.

Crude oil is showing convergence with its 20 Hr and 50 Hr moving averages.