Crude Oil prices advanced 3.07% against the USD for the 24 hour period ending 23:00GMT, closing at 60.77, amid a disruption in Libyan crude oil exports.

Oil prices were also supported, after Saudi Arabia raised its official selling prices to the US and the Northwest Europe.

Additionally, the American Petroleum Institute reported that the US crude oil inventories dropped by 1.5 million barrels last week, declining for the first time this year, thus inflating the commodity’s price.

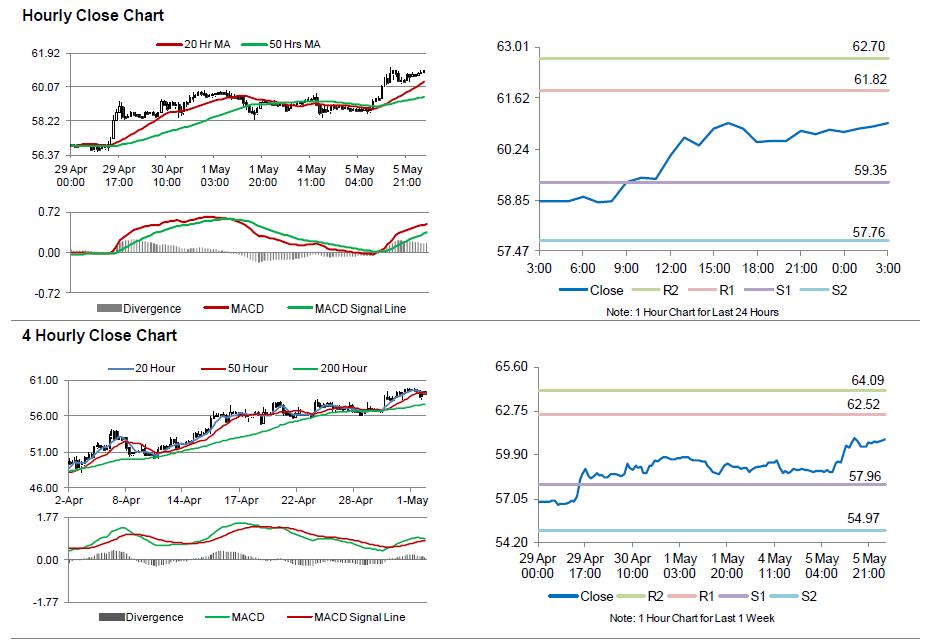

In the Asian session, at GMT0300, the pair is trading at 60.95, with the oil trading 0.3% higher from yesterday’s close.

The pair is expected to find support at 59.35, and a fall through could take it to the next support level of 57.75. The pair is expected to find its first resistance at 61.82, and a rise through could take it to the next resistance level of 62.69.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.