Crude Oil prices declined 2.02% against the USD for the 24 hour period ending 23:00GMT, closing at 60.03, as supply glut worries continued to persist after a rise in OPEC oil supply more than offset a decline in US crude oil stockpiles.

Data showed that the OPEC crude supply rose by 160,000 barrels per day to 31.21 million barrels a day in April, marking its highest level since September 2012.

Meanwhile, the EIA reported that US crude oil inventories narrowed by 2.2 million barrels to 484.8 million barrels in the week ended 08 May, while markets expected it to decline by 0.25 million barrels.

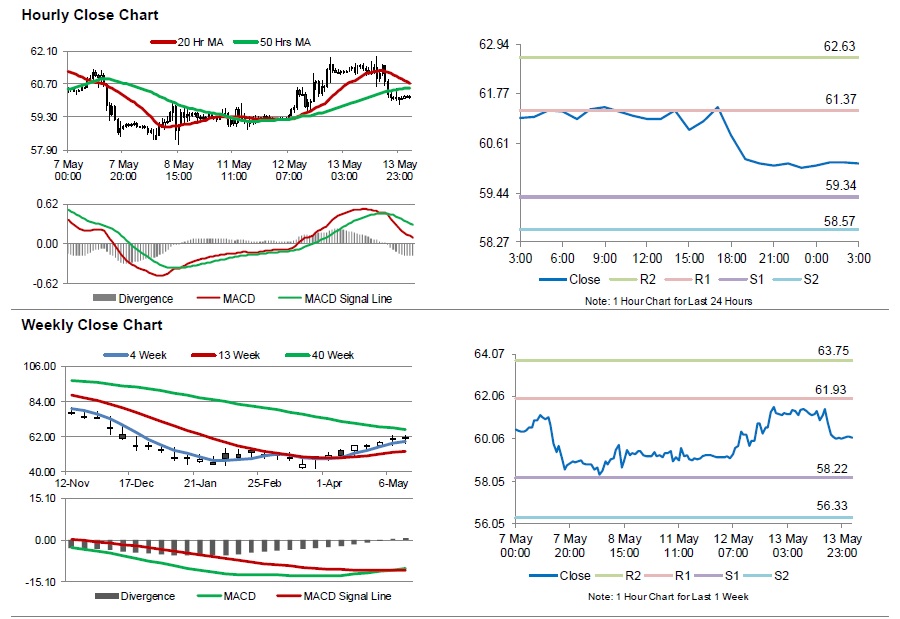

In the Asian session, at GMT0300, the pair is trading at 60.12, with the oil trading 0.15% higher from yesterday’s close.

The pair is expected to find support at 59.34, and a fall through could take it to the next support level of 58.56. The pair is expected to find its first resistance at 61.37, and a rise through could take it to the next resistance level of 62.62.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.