For the 24 hours to 23:00 GMT, Crude Oil rose 0.07% against the USD and closed at USD54.86 per barrel on Friday, after the Yemeni separatists attacked over Saudi’s oil facility. Meanwhile, the Organisation of the Petroleum Exporting Countries (OPEC), trimmed its oil demand forecast for 2019 by 40,000 per day to 1.10 million barrels per day and hinted that the market would experience surplus in 2020. Separately, fresh figures from Baker Hughes disclosed that the number of active oil rigs rose by 6 to 770 in the week ended 16 August 2019.

In the Asian session, at GMT0300, the pair is trading at 55.44, with oil trading 1.06% higher against the USD from Friday’s close.

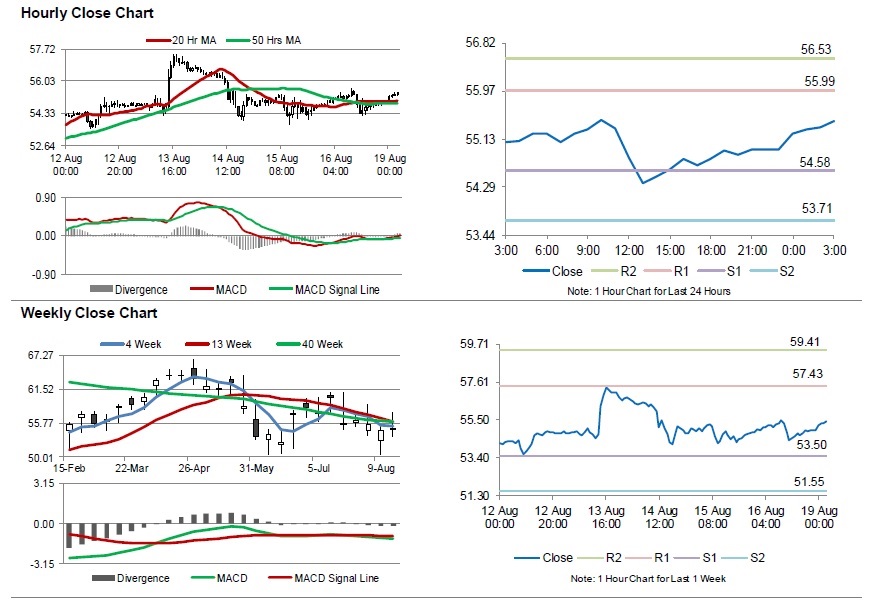

The pair is expected to find support at 54.58, and a fall through could take it to the next support level of 53.71. The pair is expected to find its first resistance at 55.99, and a rise through could take it to the next resistance level of 56.53.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.