For the 24 hours to 23:00 GMT, Crude Oil declined 3.38% against the USD and closed at USD55.95 per barrel, amid reports that the US President, Donald Trump, is planning to ease sanctions on Iran raising the possibility of the return of Iranian oil to the global market.

In a major news, the Organization of the Petroleum Exporting Countries (OPEC) lowered its 2019 global oil demand growth forecast by 80,000 barrels per day to1.02 million barrels per day, citing weak demand and economic growth slowdown.

Meanwhile, the Energy Information Administration (EIA) report indicated that US crude oil stockpiles fell by 6.9 million barrels to 416.1 million in the week ended 06 September 2019.

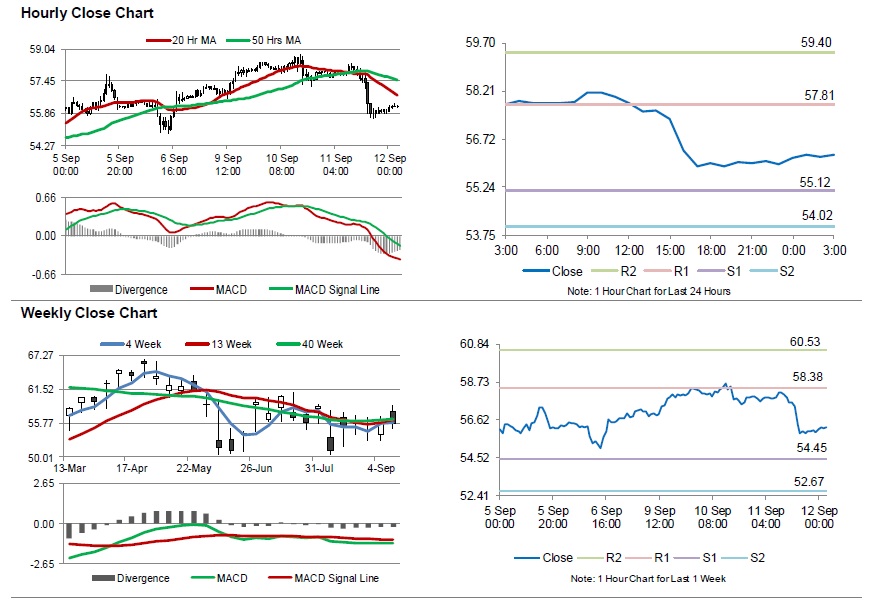

In the Asian session, at GMT0300, the pair is trading at 56.22, with oil trading 0.48% higher against the USD from yesterday’s close.

The pair is expected to find support at 55.12, and a fall through could take it to the next support level of 54.02. The pair is expected to find its first resistance at 57.81, and a rise through could take it to the next resistance level of 59.40.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.