For the 24 hours to 23:00 GMT, Crude Oil rose 3.02% against the USD and closed at USD63.02 per barrel on Friday, after US air strike in Iraq killed Iranian military leader, fuelling fears of an escalation of tensions in the Middle East that could disrupt the crude supply. Additionally, Baker Hughes reported that US oil rig count fell by 7 to 670 in the week ended 03 January 2020. Furthermore, the Energy Information Administration (EIA) report indicated that US crude oil stockpiles fell by 11.5 million barrels to 429.9 million, marking its largest drop since June 2019 in the week ended 27 December 2019.

In the Asian session, at GMT0400, the pair is trading at 64.64, with oil trading 2.57% higher against the USD from Friday’s close.

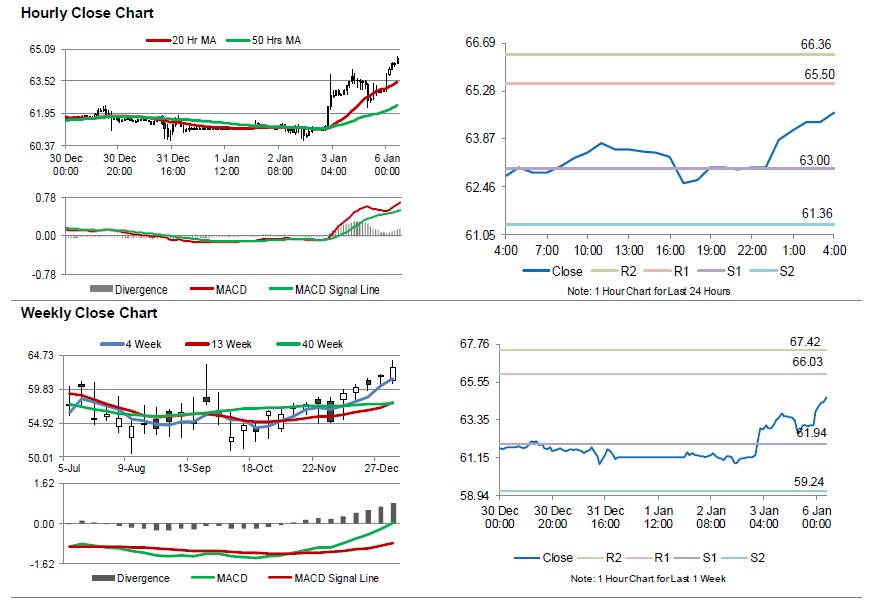

The pair is expected to find support at 63.00, and a fall through could take it to the next support level of 61.36. The pair is expected to find its first resistance at 65.50, and a rise through could take it to the next resistance level of 66.36.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.