On Friday, Crude Oil prices declined 0.20% against the USD for the period ending 21:00GMT, closing at 82.93. However, losses were capped after the US reported upbeat housing starts data and after consumer sentiment rose more than expected in October, thus increasing the demand outlook of the commodity from the world’s biggest consumer of oil. Meanwhile, concerns over a supply glut continue to weigh on oil prices.

In the Asian session, at GMT0300, the pair is trading at 83.27, with oil trading 0.41% higher from Friday’s close.

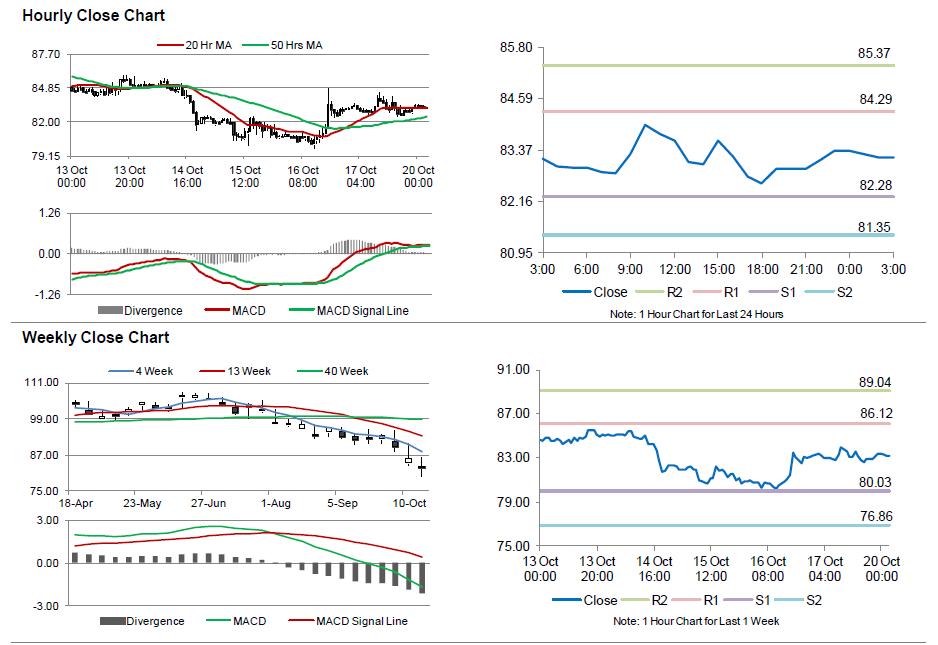

The pair is expected to find support at 82.32, and a fall through could take it to the next support level of 81.37. The pair is expected to find its first resistance at 84.33, and a rise through could take it to the next resistance level of 85.39.

Crude oil is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.