For the 24 hours to 23:00 GMT, Crude Oil declined 3.0% against the USD and closed at USD55.06 per barrel, after the International Energy Agency (IEA) lowered its global oil demand forecasts for this year and next.

The IEA, in its monthly report, stated that it now expects oil demand to grow by 1.5 million barrels per day (bpd) this year and 1.3 million bpd next year, both revised down by 100,000 bpd.

Separately, the American Petroleum Institute (API) reported that US crude oil inventories surprisingly rose by 6.5 million barrels to 461.8 million barrels during the week ended 10 November.

In the Asian session, at GMT0400, the pair is trading at 55.13, with oil trading 0.13% higher against the USD from yesterday’s close.

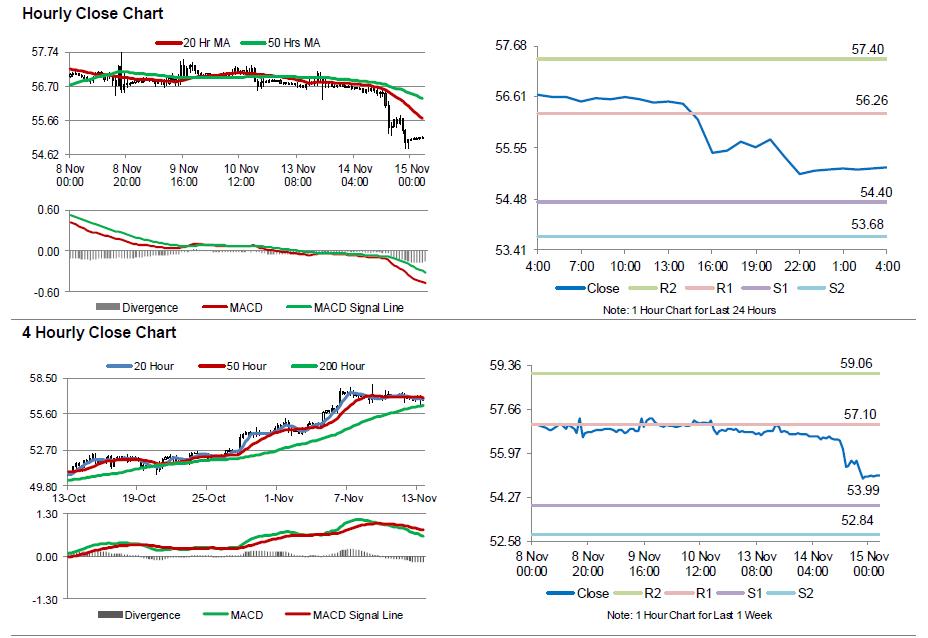

The pair is expected to find support at 54.4033, and a fall through could take it to the next support level of 53.6767. The pair is expected to find its first resistance at 56.2633, and a rise through could take it to the next resistance level of 57.3967.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.