For the 24 hours to 23:00 GMT, Crude Oil declined 0.64% against the USD and closed at USD55.81 per barrel, amid speculation that China’s virus could lower fuel demand. Meanwhile, the Energy Information Administration (EIA) reported that US crude inventories fell by 0.41 million barrels for the week ended 17 January.

In the Asian session, at GMT0400, the pair is trading at 55.64, with oil trading 0.30% lower against the USD from yesterday’s close, amid fears that the China coronavirus that has killed 25 so far may spread, reducing travel, fuel demand and economic prospects.

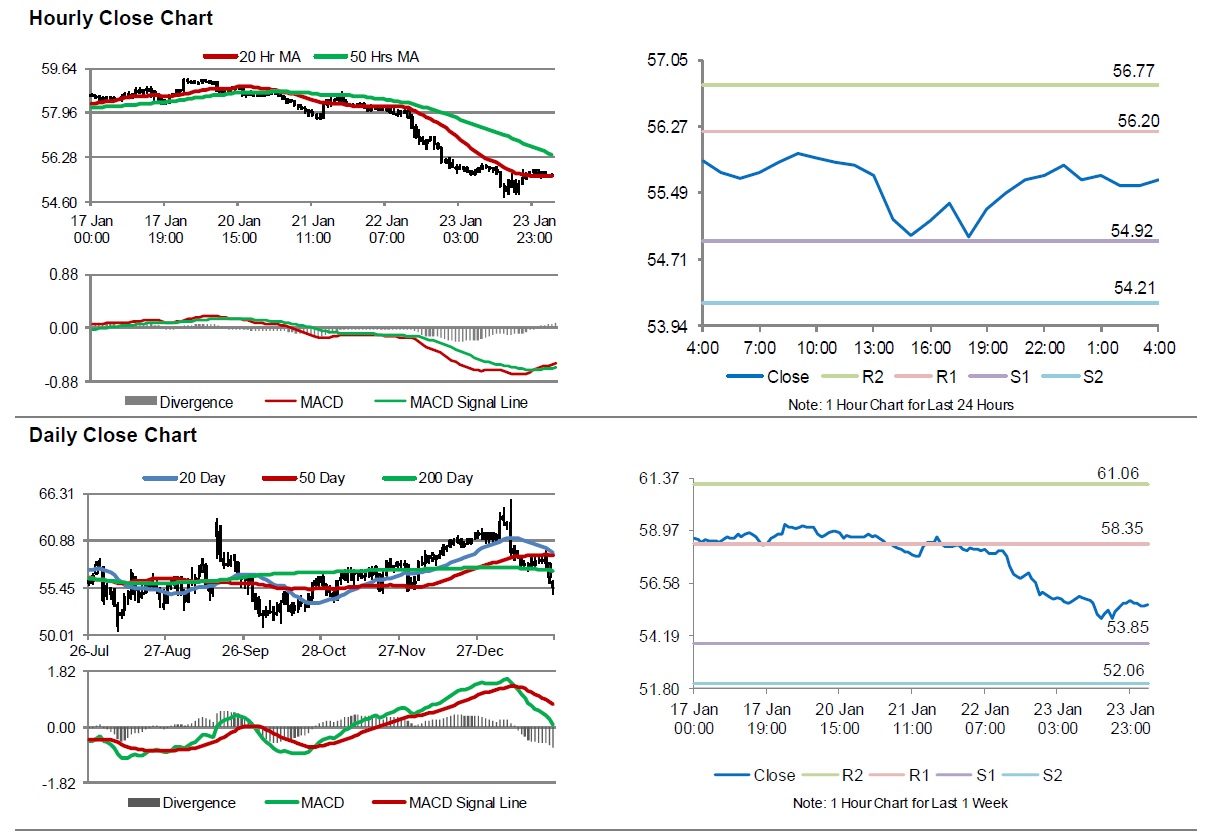

The pair is expected to find support at 54.92, and a fall through could take it to the next support level of 54.21. The pair is expected to find its first resistance at 56.20, and a rise through could take it to the next resistance level of 56.77.

Crude oil is showing convergence with its 20 Hr and trading below its 50 Hr moving average.