Crude Oil prices declined 0.64% against the USD for the 24 hour period ending 23:00GMT, closing at 75.58, after the fuel demand outlook was threatened from the Japanese economy, world’s third biggest economy as official data revealed that Japan unexpectedly fell into recession in 3Q 2014. Similarly, crude prices were further weighed down by poor industrial production data from the US.

Yesterday, Venezuela’s Foreign Minister, Rafael Ramirez stated that the OPEC would increase coordination in the face of falling oil prices. Meanwhile, a leading broker indicated that the OPEC would be at loss if it decides to slash its production as it would boost US shale oil production.

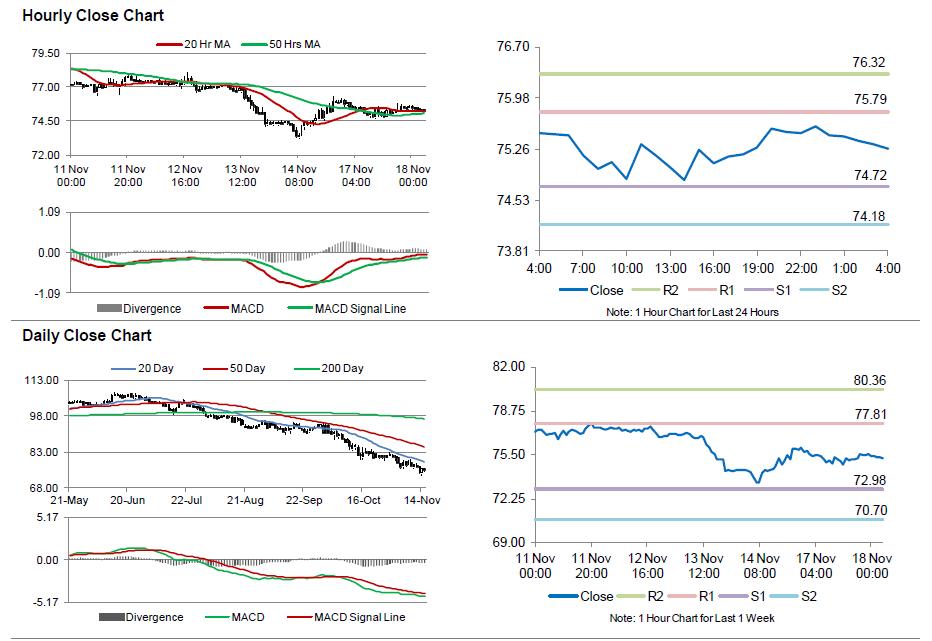

In the Asian session, at GMT0400, the pair is trading at 75.26, with the oil trading 0.42% lower from yesterday’s close.

The pair is expected to find support at 74.72, and a fall through could take it to the next support level of 74.18. The pair is expected to find its first resistance at 75.79, and a rise through could take it to the next resistance level of 76.32.

Crude oil is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.