Crude Oil prices declined 1.99% against the USD for the 24 hour period ending 23:00GMT, closing at 88.55, after the IMF trimmed its global economic growth forecasts for the third time this year, raising demand concerns of the commodity. Additionally, downbeat German industrial data in August, further pushed oil prices lower.

Separately, the American Petroleum Institute (API) reported that the US crude oil inventories rose 5.1 million barrels in the previous week.

In the Asian session, at GMT0300, the pair is trading at 88.5, with the oil trading 0.06% lower from yesterday’s close.

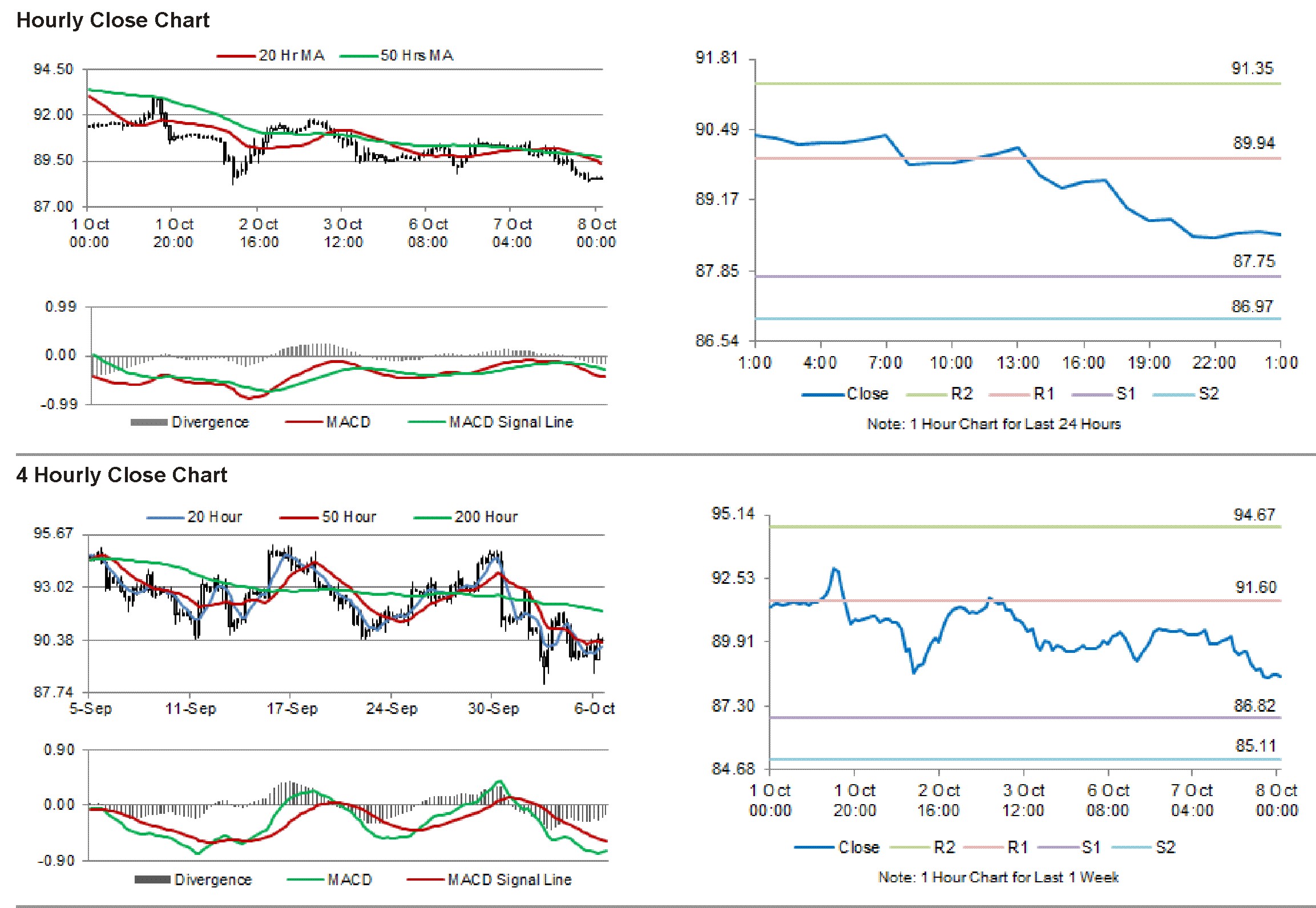

The pair is expected to find support at 87.73, and a fall through could take it to the next support level of 86.96. The pair is expected to find its first resistance at 89.92, and a rise through could take it to the next resistance level of 91.34.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.