For the 24 hours to 23:00 GMT, Crude Oil declined 5.21% against the USD and closed at 31.46, after Saudi Arabia’s oil minister, Ali Al-Naimi, shattered hopes for output cuts, coupled with a higher-than-expected build in US crude stockpiles.

Yesterday, the American Petroleum Institute (API) disclosed that US oil inventories rose by 7.1 million barrels to 506.2 million barrels in the week ended 19 February, while investors had expected an increase of 3.4 million barrels.

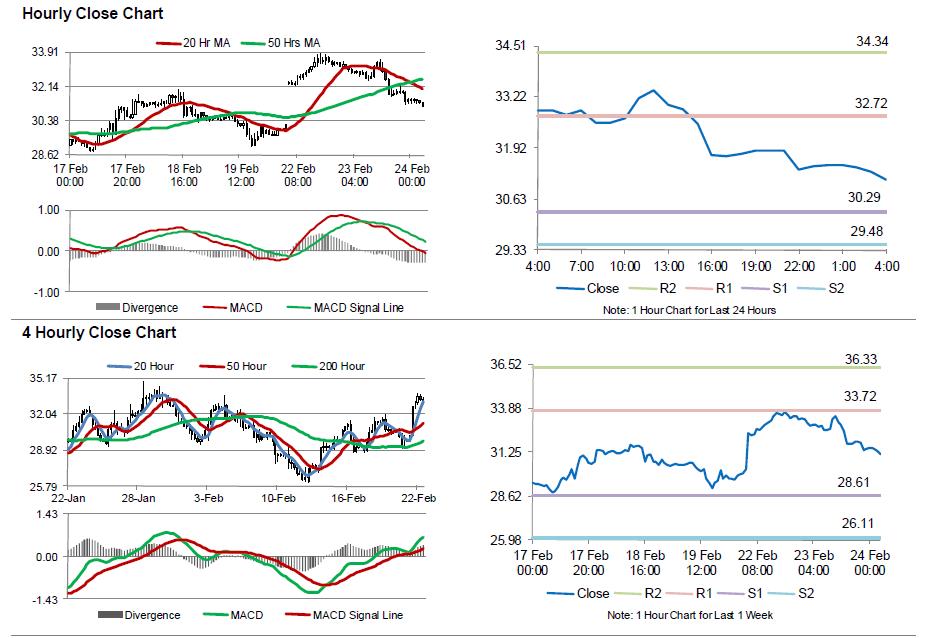

In the Asian session, at GMT0400, the pair is trading at 31.1, with the oil trading 1.14% lower from yesterday’s close.

The pair is expected to find support at 30.29, and a fall through could take it to the next support level of 29.48. The pair is expected to find its first resistance at 32.72, and a rise through could take it to the next resistance level of 34.34.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.