Crude Oil prices declined 0.83% against the USD for the 24 hour period ending 23:00GMT, closing at 58.36, as supply concerns persisted in the oil market after China’s crude oil imports dropped 11% YoY in May. However, the Energy Information Administration (EIA) stated that the oil production from 7 major US shale plays would fall by 91,000 barrels a day in July from the earlier month.

In the Asian session, at GMT0300, the pair is trading at 58.38, with the oil trading a tad higher from yesterday’s close.

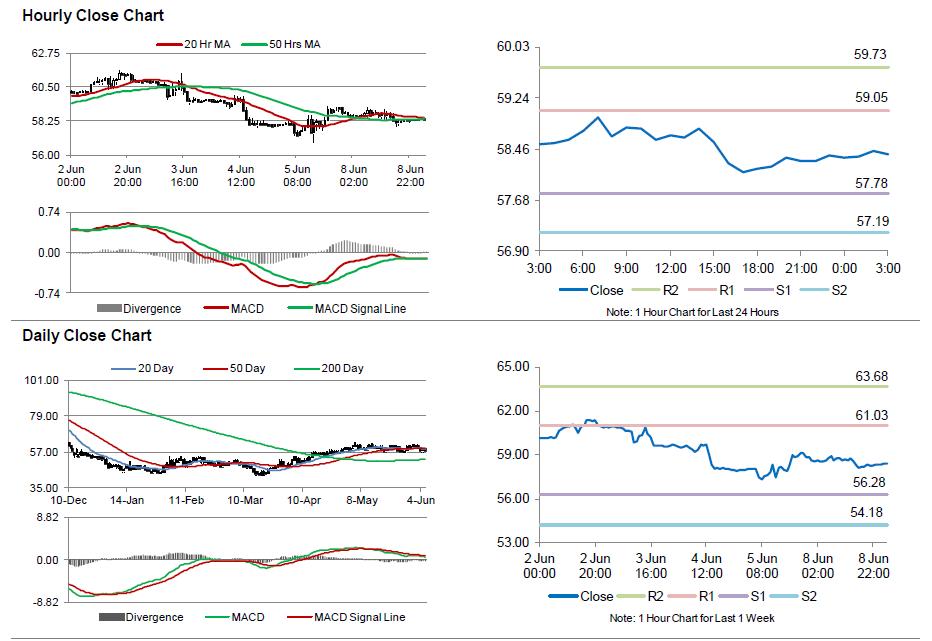

The pair is expected to find support at 57.78, and a fall through could take it to the next support level of 57.18. The pair is expected to find its first resistance at 59.05, and a rise through could take it to the next resistance level of 59.72.

Crude oil is showing convergence with its 20 Hr and 50 Hr moving averages.