Crude Oil prices declined 1.42% against the USD for the 24 hour period ending 23:00GMT, closing at 44.51, after a weaker-than-expected U.S. jobs data weighed on the demand outlook for energy.

Meanwhile, the Baker Hughes weekly rig count report stated that the number of working US oil rigs fell to its five-year low. As per the report, the number of oil rigs fell by 26 to 614 for the week ending 25 September.

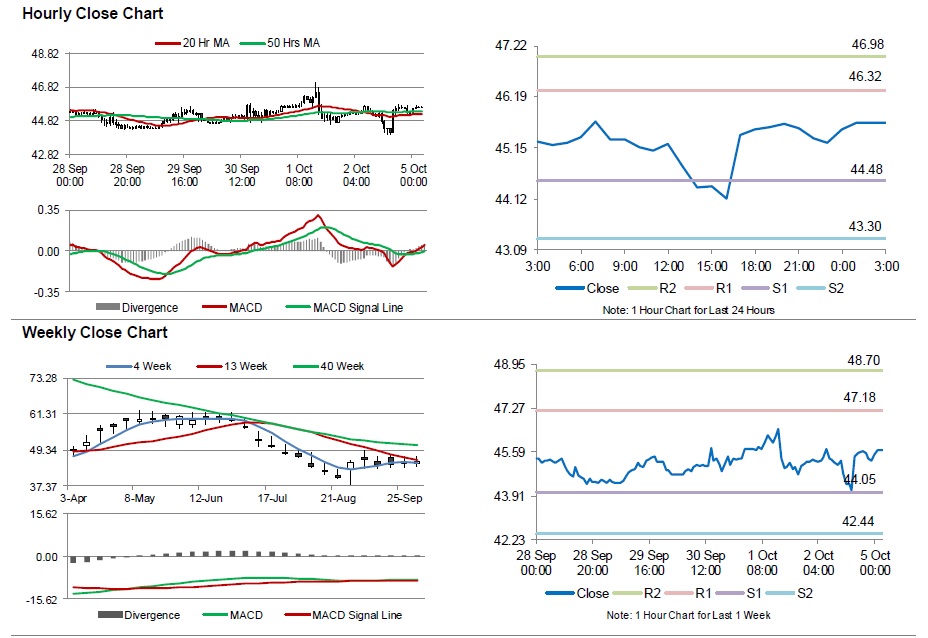

In the Asian session, at GMT0300, the pair is trading at 45.65, with the oil trading 2.56% higher from Friday’s close.

The pair is expected to find support at 44.48, and a fall through could take it to the next support level of 43.30. The pair is expected to find its first resistance at 46.32, and a rise through could take it to the next resistance level of 46.98.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.