For the 24 hours to 23:00 GMT, Crude Oil declined 1.09% against the USD and closed at USD52.44 per barrel on Friday, pressured by concerns over the health of the world’s second-largest oil consumer, China, after it posted the worst decline in exports since 2009 in December.

Separately, Baker Hughes disclosed that number of active oil rigs in US fell by 7 to 522 last week, recording its first decline in 10 weeks.

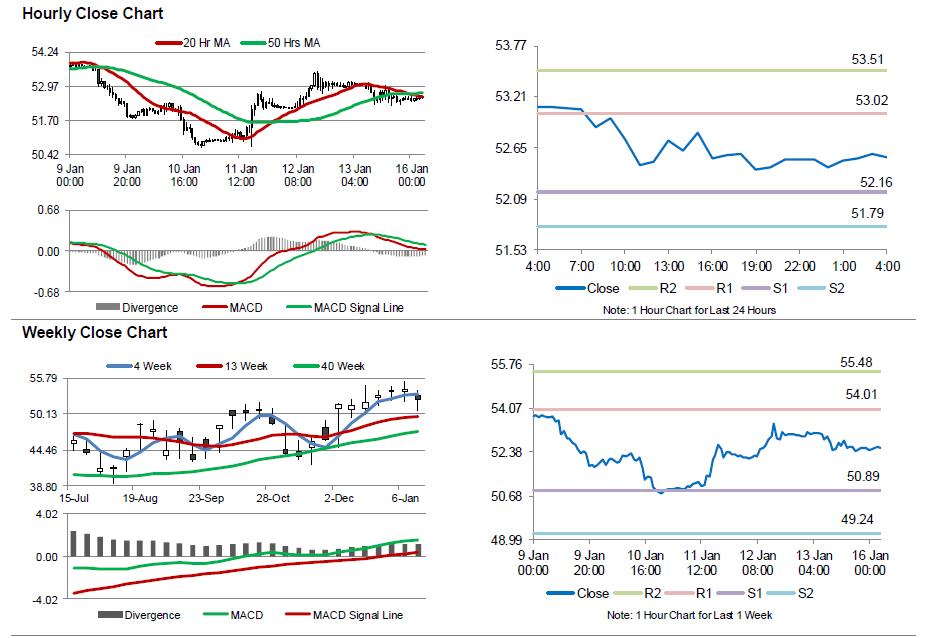

In the Asian session, at GMT0400, the pair is trading at 52.54, with the oil trading 0.19% higher from Friday’s close.

The pair is expected to find support at 52.16, and a fall through could take it to the next support level of 51.79. The pair is expected to find its first resistance at 53.02, and a rise through could take it to the next resistance level of 53.51.

Crude oil is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.