Crude Oil prices advanced 1.52% against the USD for the 24-hour period ending 23:00GMT, closing at USD53.55, amid signs that the Organisation of the Petroleum Exporting Countries (OPEC) and other producers are curbing output and as geopolitical tensions arose between the United States and Tehran after Iran’s latest missile test.

However, oil prices pared some of its gains after the Energy Information Administration (EIA) reported a build of 6.5 million barrels in US crude stockpiles to 494.8 million barrels during the week ended 27 January 2017.

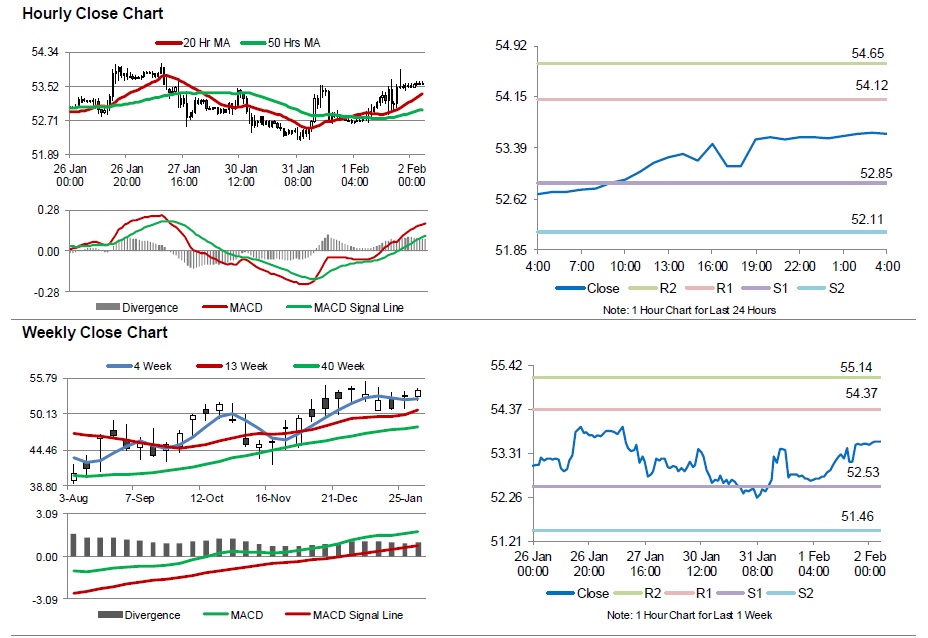

In the Asian session, at GMT0400, the pair is trading at 53.59, with the oil trading 0.07% higher against the USD from yesterday’s close.

The pair is expected to find support at 52.85, and a fall through could take it to the next support level of 52.11. The pair is expected to find its first resistance at 54.12, and a rise through could take it to the next resistance level of 54.65.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.