For the 24 hours to 23:00 GMT, Crude Oil rose 1.16% against the USD and closed at USD64.32 per barrel on Friday.

However, gains in crude prices were kept in check, after Baker Hughes showed that US oil rig count rose by 10 to 752 during the week ended 12 January.

Additionally, the Russian Energy Minister, Alexander Novak stated that OPEC and non-OPEC producers could discuss a possible exit from the deal to curb crude output at a meeting in Oman next week. Additionally, the US President, Donald Trump announced the waiver of nuclear sanctions on Iran, but warned that this would be the last such waiver if they fail to agree on radical changes.

In the Asian session, at GMT0400, the pair is trading at 64.39, with oil trading 0.11% higher against the USD from Friday’s close.

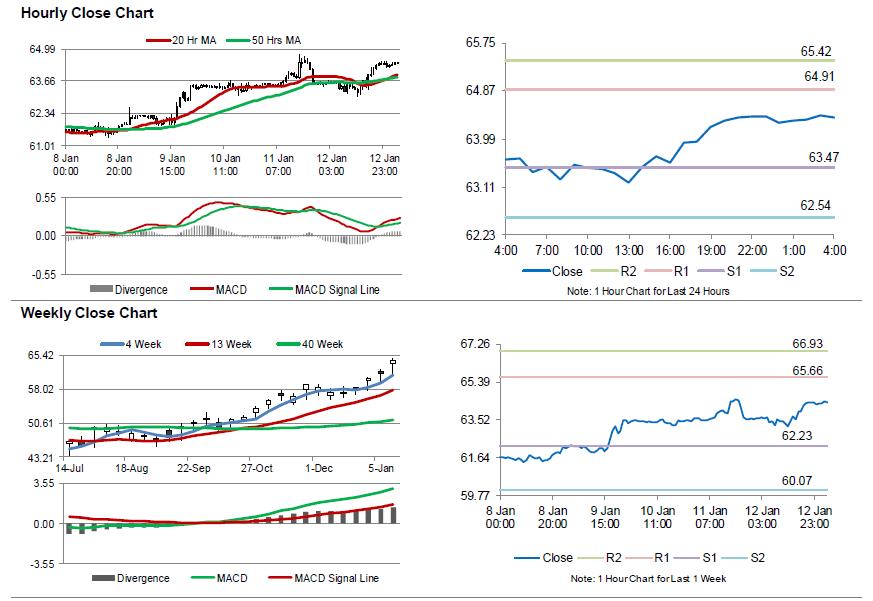

The pair is expected to find support at 63.47, and a fall through could take it to the next support level of 62.54. The pair is expected to find its first resistance at 64.91, and a rise through could take it to the next resistance level of 65.42.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.