Crude Oil prices declined 1.89% against the USD for the 24 hour period ending 23:00GMT, closing at 46.72.

Oil prices were pressured after the IEA reported that the world oil market would likely remain oversupplied next year, despite a fall in production from non-OPEC producer countries.

In its monthly oil market report, the organisation cut its oil demand growth forecast for the next year by 2,00,000 barrels per day, compared to its previous assessment in September. It further stated that world oil consumption will rise by 1.8 million barrels per day in 2015, reaching a five-year high, and by 1.2 million barrels a day in 2016.

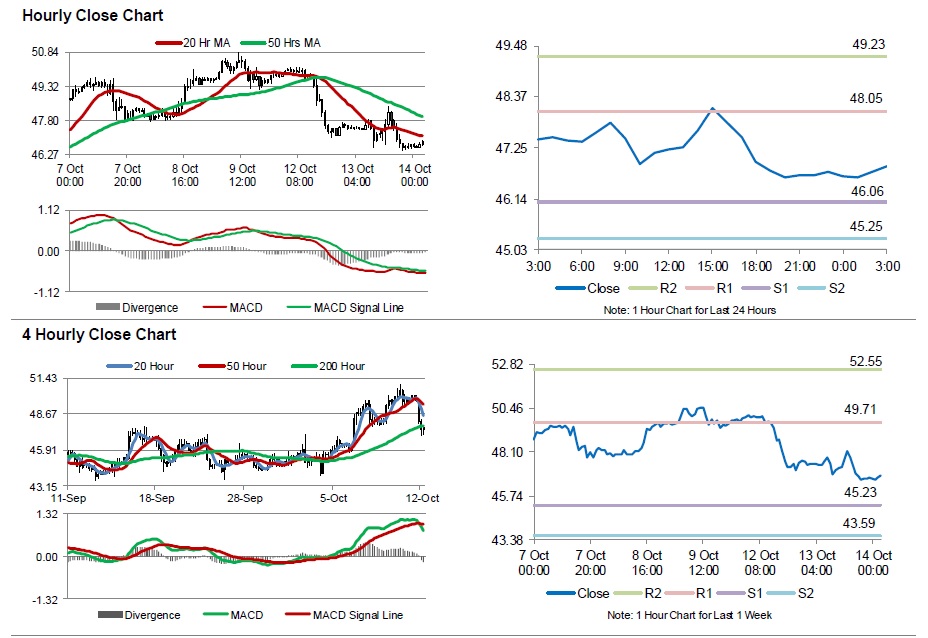

In the Asian session, at GMT0300, the pair is trading at 46.86, with the oil trading 0.3% higher from yesterday’s close.

The pair is expected to find support at 46.06, and a fall through could take it to the next support level of 45.25. The pair is expected to find its first resistance at 48.05, and a rise through could take it to the next resistance level of 49.23.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.