For the 24 hours to 23:00 GMT, Crude Oil declined 0.47% against the USD and closed at USD63.45 per ounce on Friday, after the International Energy Agency (IEA), in its monthly report, warned that US oil output is set for “explosive” growth this year.

Nevertheless, the agency stated that global oil surplus is tightening substantially, amid efforts by the Organisation of the Petroleum Exporting Countries (OPEC) and due to a sharp drop in crude supply from Venezuela.

Separately, Baker Hughes revealed that active oil rigs in US fell by 5 to 747 in the week ended 19 January.

In the Asian session, at GMT0400, the pair is trading at 63.60, with oil trading 0.24% higher against the USD from Friday’s close, after Saudi Arabia’s Energy Minister, Khalid al-Falih urged major oil producing nations to extend their cooperation on production cuts into 2019.

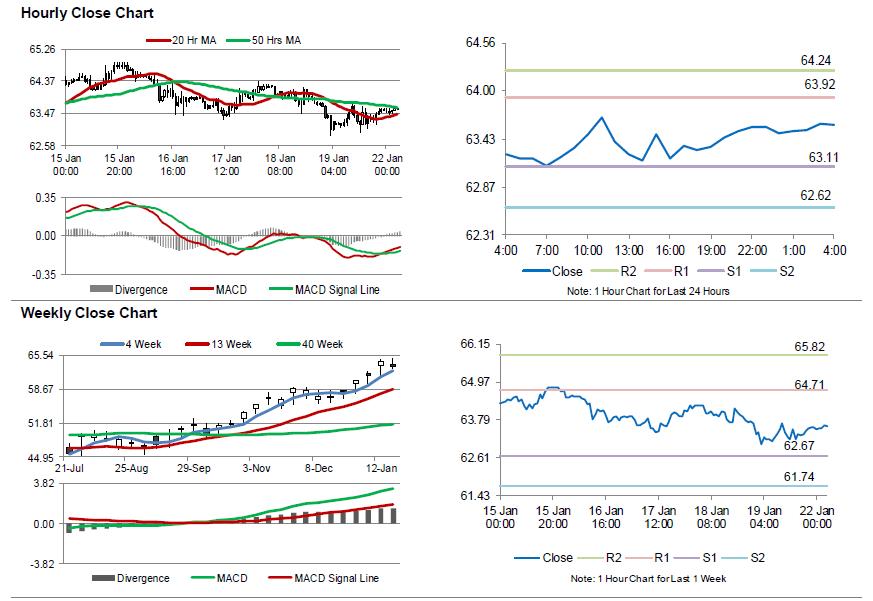

The pair is expected to find support at 63.11, and a fall through could take it to the next support level of 62.62. The pair is expected to find its first resistance at 63.92, and a rise through could take it to the next resistance level of 64.24.

Crude oil is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.