For the 24 hours to 23:00 GMT, Crude Oil rose 1.19% against the USD and closed at USD63.58 per barrel, following the shutdown of a key oilfield in Libya and hawkish remarks from Saudi Arabia’s Energy Minister.

Saudi Arabia’s Energy Minister, Khalid al-Falih, stated that global oil market is stabilising and that he expected oil inventories to continue declining in 2018.

Separately, Baker Hughes disclosed that US oil rig count rose by 1 to 799 in the week ended 23 February, hitting its highest level since April 2015.

In the Asian session, at GMT0400, the pair is trading at 63.77, with oil trading 0.3% higher against the USD from Friday’s close, after Rystad Energy forecasted that oil production in East and Southeast Asia would fall by 20.0% between 2017 and 2025.

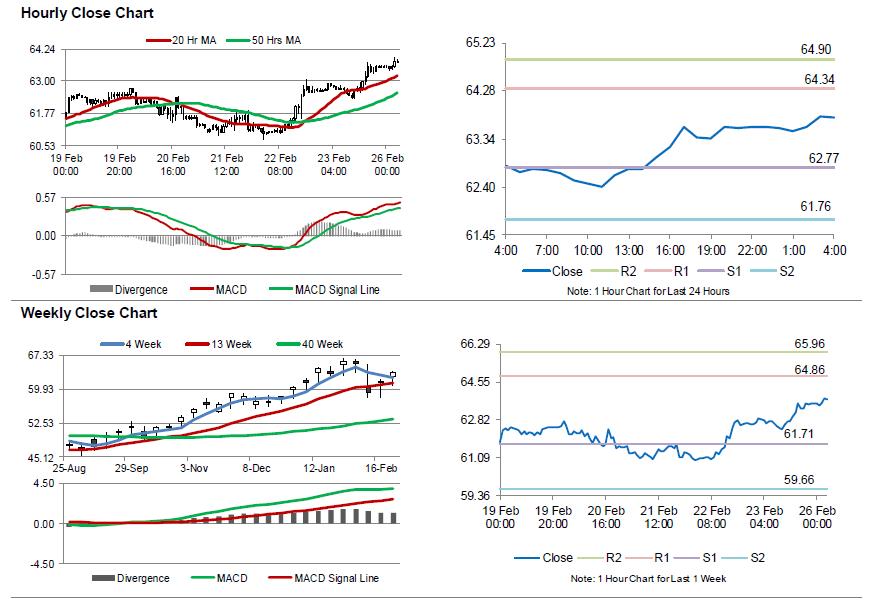

The pair is expected to find support at 62.77, and a fall through could take it to the next support level of 61.76. The pair is expected to find its first resistance at 64.34, and a rise through could take it to the next resistance level of 64.90.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.