For the 24 hours to 23:00 GMT, the Crude Oil rose 9.65% against the USD and closed at 32.60, as investors ignored a considerable rise in US crude stockpiles and focussed on prospects of a meeting between Russia and the OPEC producers to address the ongoing global supply glut concerns.

Yesterday, the Energy Information Administration (EIA) in its weekly report disclosed, that US crude stockpiles increased more-than-expected by 7.8 million barrels to a record high 502.7 million barrels in the week ended 29 January, while markets expected an increase of 4.8 million barrels.

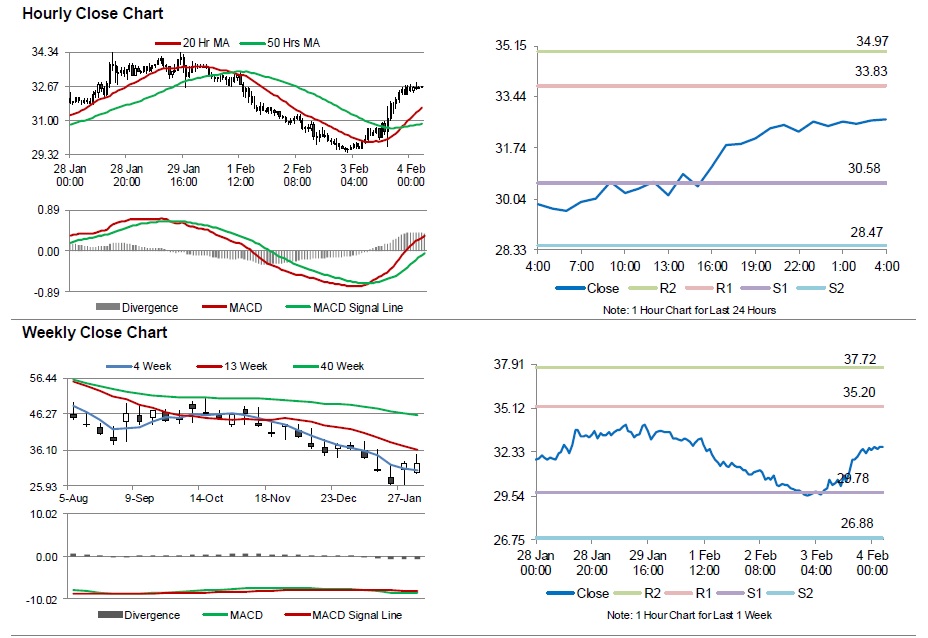

In the Asian session, at GMT0400, the pair is trading at 32.68, with the oil trading 0.25% higher from yesterday’s close.

The pair is expected to find support at 30.58, and a fall through could take it to the next support level of 28.47. The pair is expected to find its first resistance at 33.83, and a rise through could take it to the next resistance level of 34.97.

Crude oil is trading above its 20 Hr and 50 Hr moving averages.