For the 24 hours to 23:00 GMT, Crude Oil rose 0.46% against the USD and closed at USD48.30 per barrel, after the Organisation of the Petroleum Exporting Countries (OPEC) reported a decline in its August oil production and forecasted higher global oil demand in 2018.

In a monthly report, the OPEC stated that its oil output declined by 79,000 barrels per day (bpd) to 32.76 million bpd in August. Moreover, it revised up its global oil demand forecast by 1.42 million bpd in 2017 and by 1.35 million bpd in 2018.

However, gains in crude prices were limited, after the American Petroleum Institute (API) reported that US crude oil inventories rose by 6.2 million barrels to 468.8 million barrels in the week ended 08 September.

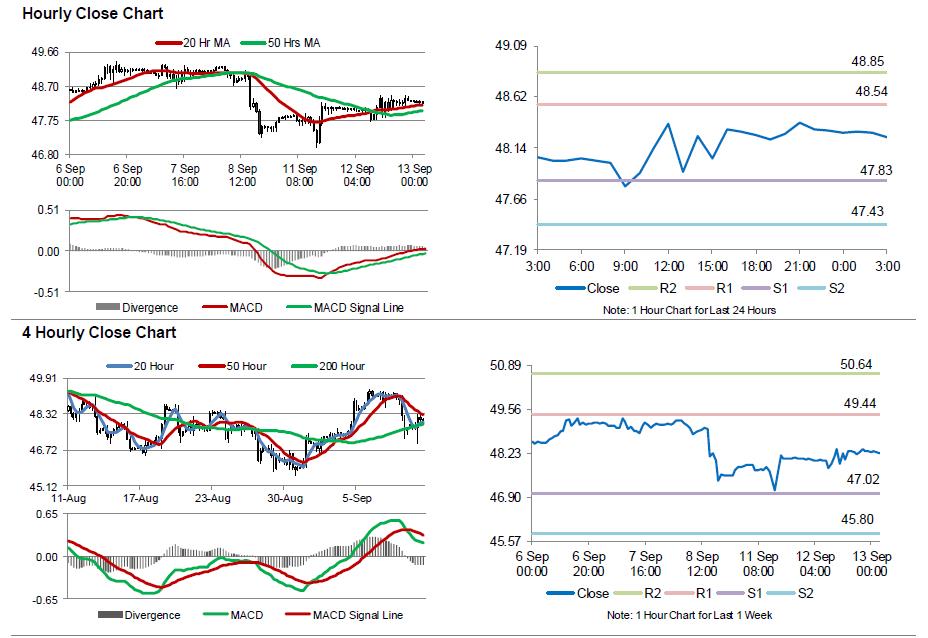

In the Asian session, at GMT0300, the pair is trading at 48.24, with the oil trading 0.12% lower against the USD from yesterday’s close.

The pair is expected to find support at 47.83, and a fall through could take it to the next support level of 47.43. The pair is expected to find its first resistance at 48.54, and a rise through could take it to the next resistance level of 48.85.

Crude oil is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.