For the 24 hours to 23:00 GMT, Crude Oil declined 3.22% against the USD and closed at USD45.62 per barrel, on reports that oil exports by the Organization of the Petroleum Exporting Countries (OPEC) rose in June, despite its pledge to hold back production. Additionally, news that Russia would rule out any proposals to deepen the global production cuts weighed on the commodity. OPEC exported 25.92 million barrels per day (bpd) in June, up from 450,000 bpd in the previous month.

However, losses in crude prices were trimmed after the American Petroleum Institute (API) showed that US crude oil inventories fell more-than-expected by 5.8 million barrels to 503.7 million barrels in the week ended 30 June.

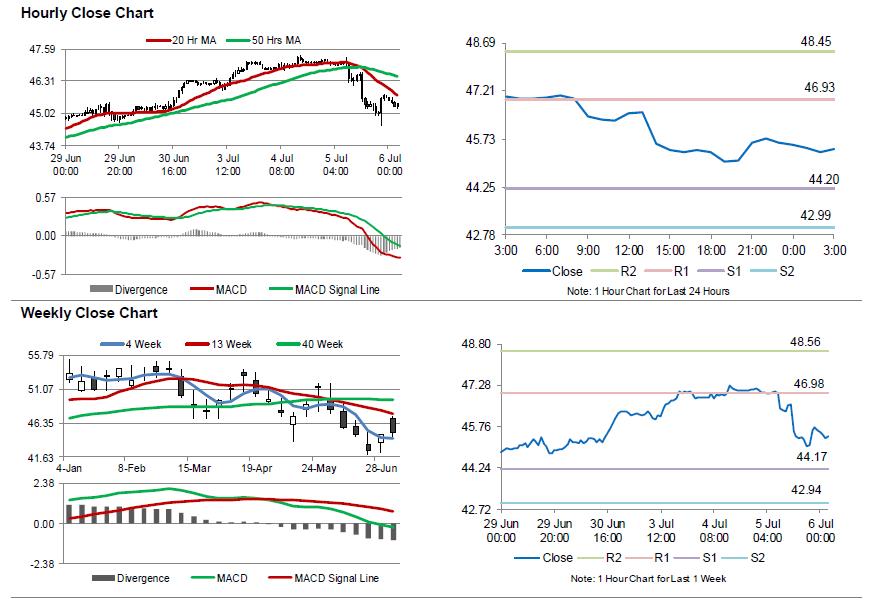

In the Asian session, at GMT0300, the pair is trading at 45.41, with the oil trading 0.46% lower against the USD from yesterday’s close.

The pair is expected to find support at 44.20, and a fall through could take it to the next support level of 42.99. The pair is expected to find its first resistance at 46.93, and a rise through could take it to the next resistance level of 48.45.

Crude oil is trading below its 20 Hr and 50 Hr moving averages.